【Blend】NFT-backed P2P indefinite lending protocol released by Blur / Will this be a move to further push out OpenSea?

The NFT marketplace war may be over by the end of 2023.

Good morning.

This is Mitsui, a web3 researcher.

Today, I researched "Blend.

"Table of Contents"

1. What is Blend?

- Overview

- How it works

- Also works with Loyalty Programs

2. Blur has begun to gain a competitive advantage

What is Blend?

Blend is a P2P indefinite NFT-backed lending protocol released on May 2, 2023 by the NFT marketplace Blur, developed in collaboration with members of the web3 investment firm Paradigm. The protocol was developed in collaboration with members of Paradigm, a web3 investment company.

In the NFT world, the NFTFi market has existed for some time, allowing users to borrow crypto assets using NFTs as collateral. This mechanism will increase the number of uses for NFTs that are not intended to be sold, and will stimulate trading in the NFT industry.

Several types of services already exist, and Blur has entered this market.

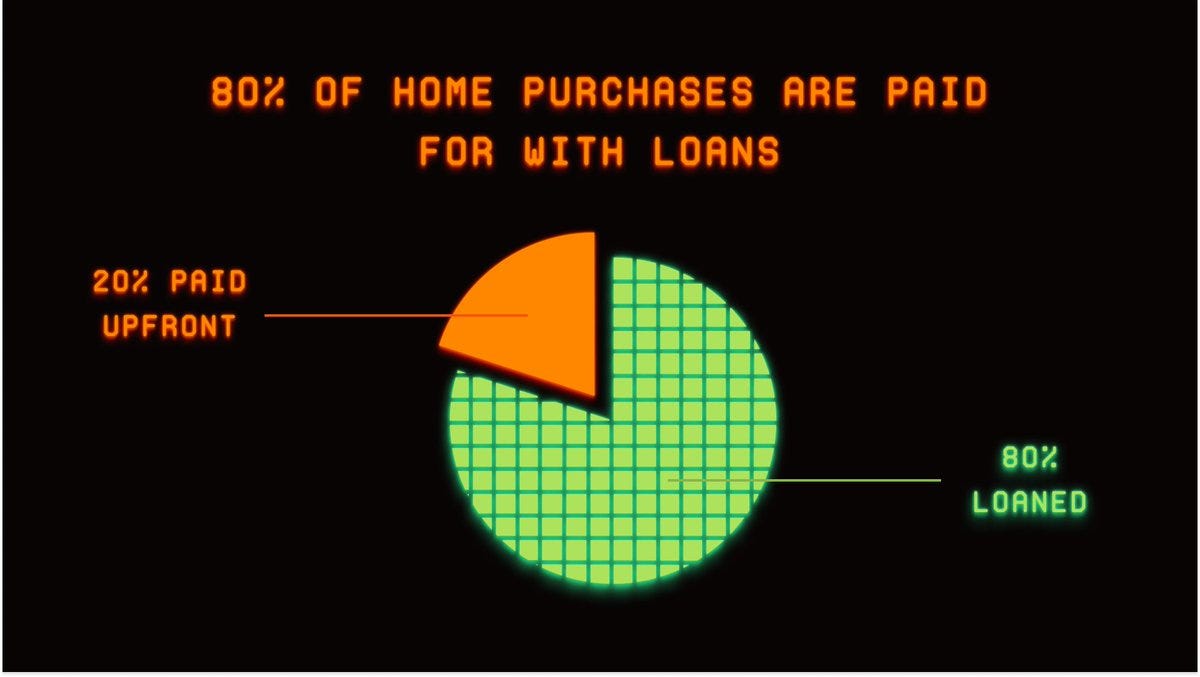

In its announcement, Blur used the example of mortgages, where 80% of the purchase of a home is financed by a loan. The NFT industry also needs a loan structure in order to conduct high-cost NFT transactions.

■Overview

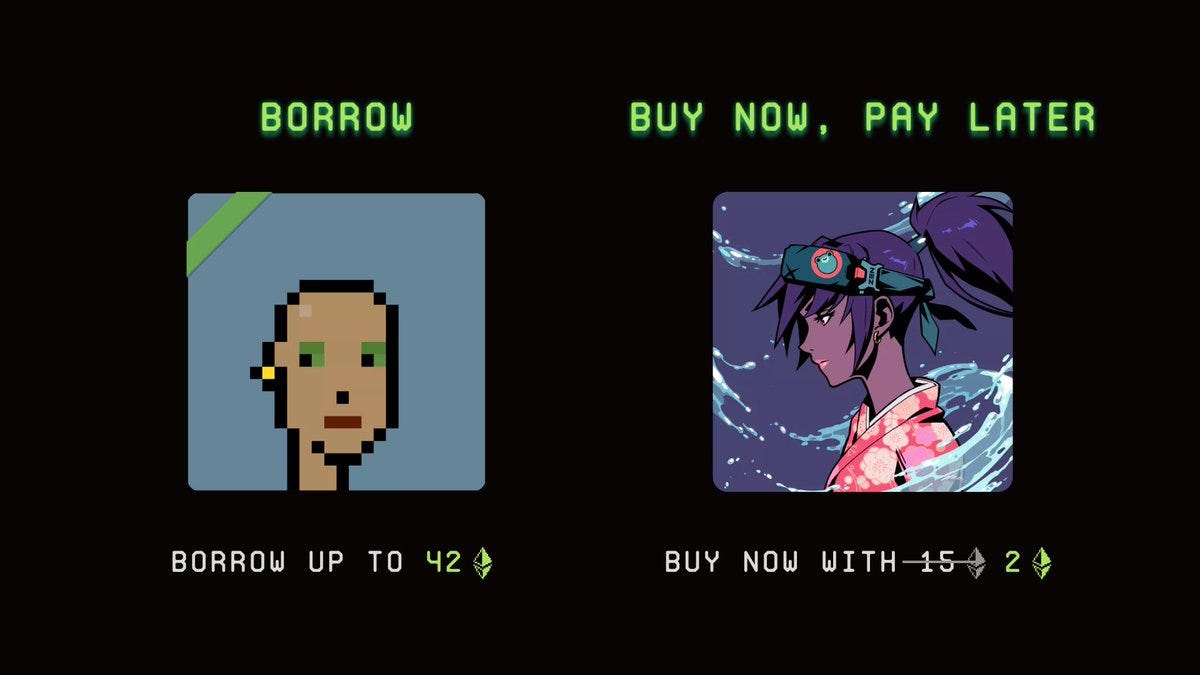

Blend is a function that "allows you to borrow ETH using NFTs as collateral. There are two uses for this function.

BORROW: Simply borrow (ex. borrow 42 ETH using CryptoPunks as collateral)

BUY NOW, PAY LATER (BNPL): Pay the difference between the amount you can borrow and the amount you can buy

Blend's BNPL is a feature that allows you to borrow ETH as collateral at the moment of purchase.

For example, let's say that the purchase price of Azuki is 15 ETH and you can borrow 13 ETH by pledging it as collateral.

The normal flow is "buy at 15 ETH -> borrow 13 ETH as collateral", but in this case, you need to prepare 15 ETH when you buy it in the first place. By utilizing Blend's BNPL, the flow is "purchase for 2 ETH, the difference between the purchase price of 15 ETH and the borrowing price of 13 ETH -> pay 13 ETH later to obtain full ownership (if you cannot pay 13 ETH, that ownership is relinquished). This will reduce the initial amount to be paid from 15 ETH to 2 ETH, making it easier to trade NFTs.

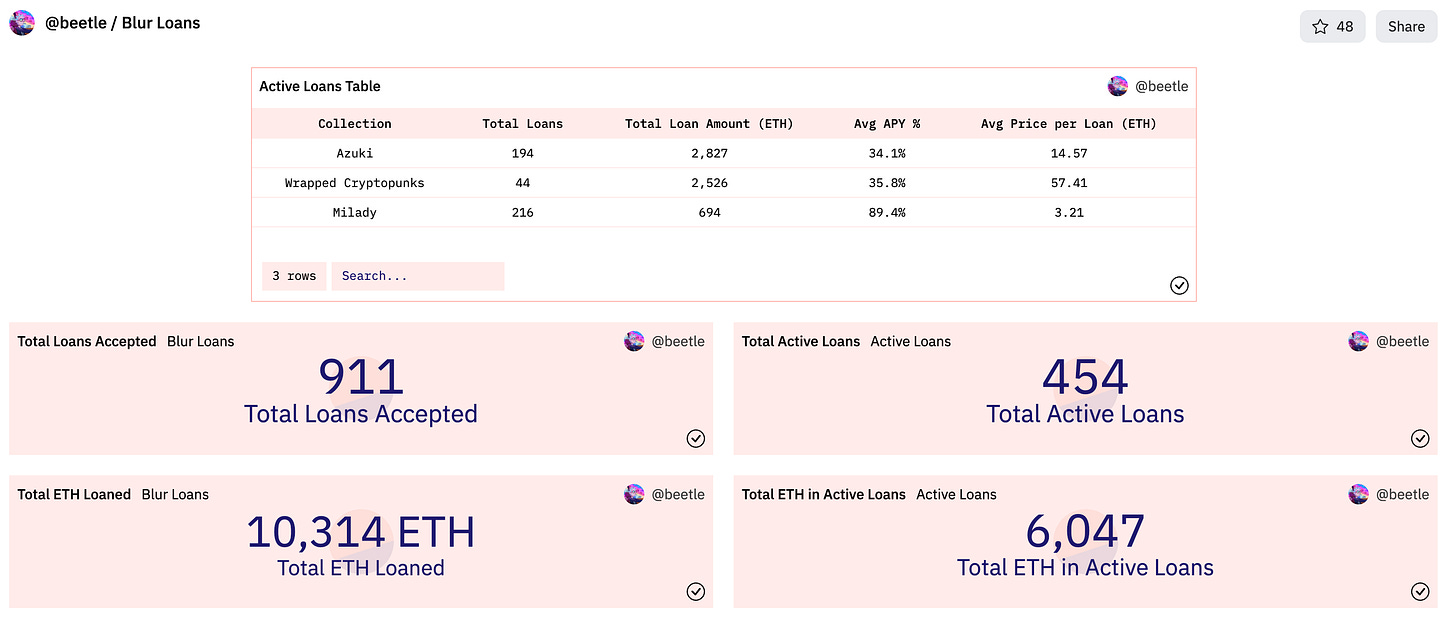

Currently, three collections (CryptoPunks, Azuki, and Miladys) are supported, and the number of supported collections will be increased in the future.

■How it Works

There are several types of NFTFi, but Blend is the closest model to P2P protocols such as NFTfi.com. Funds are lent and borrowed based on mutually agreed upon lending (borrowing) terms between individuals.

However, there are several differences from the previous NFTFi.

○ No oracle.

Most NFTFi services refer to on- and off-chain data that exists on the Internet to determine the collateral amount, interest rate, and term of the NFT. Oracle is used for that data referencing.

However, Blend does not. It is executed entirely under a P2P transaction.

○ No expiration date

Blend has no restrictions on repayment terms. Borrowers can repay at any point in time, and lenders can exercise settlement at any point in time. However, settlement will be executed if no buyer is found in the refinance auction of the loan.

○ Refinance Auction

Lenders may conduct a refinancing auction at any time they wish to settle the loan. This is a Dutch auction, and if there is a successful bidder, the loan is transferred to that person.

For example, let us assume that this is a refinancing auction when Mr. X had a "10% interest rate, 10 ETH" loan secured by Azuki. The loan is put through a Dutch auction and gradually improves from a 0% interest rate.

As a result, Mr. Y who is willing to lend Azuki as collateral at "15% interest rate and 10 ETH" appears, and Mr. X is paid the interest amount plus 10 ETH that Mr. Y lends under the new loan, and the settlement is completed. Mr. Y gets Azuki's collateral and the right to 15% interest.

At this time, even if there are no bidders up to the specified interest rate, settlement will be executed and the borrower will have to pay 10 ETH plus interest. If payment is not made, Azuki (NFT), which was pledged as collateral, will be handed over to the lender.

In short,

P2P lending and borrowing terms are determined by P2P.

No repayment term, but refinancing auction can be executed at any time for settlement.

If another borrower is found in the refinancing auction, the borrowing continues at a different interest rate.

If another borrower cannot be found at the refinancing auction, the loan is settled immediately.

This means that

The ability to transfer the interest rate on the loan allows the market principle to work, eliminating unjustifiably high or low transactions, even though it is a P2P transaction. Thus, a normal transaction will be executed without the oracle price reference.

In addition, this system improves the financial efficiency of borrowers and lenders because only the minimum necessary parts are ticked on-chain.

■ Also works with loyalty programs

Blur implemented a major airdrop of tokens not long ago. That measure attracted users from OpenSea and led to rapid growth.

And preparations for a second airdrop after the massive airdrop of $BLUR tokens have already started. The key word for the next airdrop is "loyalty": points will be awarded for listing, bidding, and lending NFTs on Blur, and $BLUR tokens will be airdropped according to those points.

In other words, if you actively use Blend, you will get a lot of $BLUR tokens in the next airdrop.

In just one day since its release, more than 900 loans have already been approved and more than 10,000 ETH has been lent. That's a tremendous amount of momentum.

Blur is beginning to secure a competitive advantage.

Here are my impressions from my research.

I feel that Blur continues to excel in its business strategy.

After the first phase, in which Blur took market share away from OpenSea with a massive airdrop, there seemed to be an atmosphere of, "Sure, the growth has been great, but now that we've airdropped, let's see what happens now...".

OpenSea also released a service to compete with Blur, and it was seen as if they would gradually regain market share.

However, the way Blur is moving, there is a sense that it is aiming to become the dominant No. 1 NFT marketplace, without letting up at all.

First of all, there is no doubt that airdropping tokens is a special move that can only be used a few times. You can't incentivize the distribution of tokens more than once, and while Blur gained market share by launching its airdrop at full throttle from the start, the fact that it gained market share means that it could be taken away by competitors using a similar strategy.

In the end, the fact that Blur took market share from OpenSea in such a short time demonstrates that the competitive advantage of the NFT marketplace was too low. Since the product (NFT) is tied to the blockchain, users can honestly put it on any marketplace.

Blur takes this fact seriously and is committed to "building competitive advantage" in the next phase.

There are two main ways to build a competitive advantage in the NFT marketplace in my opinion.

Create a product with the best UX

Create loyalty programs such as tokens.

Either you simply create the best product, or you create a "all products are similar, but I'll get more points if I use this one, so I'll choose this one! This is the case, for example, outside of the NFT marketplace. This is also used for competitive advantage of existing services other than NFT marketplace, such as credit card and QR payment.

Frankly speaking, it is difficult to differentiate products (functions) alone at this point in time. This is because in an era of easy development, functions can be quickly copied.

Therefore, the key to success is how to create a loyalty program and expand one's own economic sphere. So Blur is choosing to actively distribute tokens to loyal customers.

And Blend's aim is probably to "retain large customers"; Blur was originally a marketplace designed for professional traders. However, OpenSea started offering services for traders as well, and the features and commissions became similar.

I feel that in the end, the war of the NFT marketplace comes down to "how to capture large customers. The cycle is: "large customers, NFT sells, so large NFT projects list there, branding of the site is created, general users gather, general NFT projects list there.

Blend is only available to those who have tens of ETH (ETH holdings that can be lent) or have CryptoPunks or Azuki. Those who can use it, and who have been lending on other NFTFi's, will do it here because they can get tokens if they do it on Blur. As a result, Blend will be more active and NFT transactions within Blur will be more active. Also, by airdropping Blur tokens to large customers who have used Blend, an incentive is built for them to continue using Blur after the second large airdrop is over.

In other words, Blur will

Acquire user numbers on the first airdrop

Secure competitive advantage (especially retention of large customers) with the second airdrop

So, I think they are already stepping on the gas pedal with such vigor that they are going to make it black and white by the end of 2023. The NFT marketplace war started at the end of last year and may reach its end in just one year.

I will continue to pay attention to it!

If you found the research interesting or informative, we would appreciate it if you could help us by liking, commenting, and sharing it on social networking sites. Thank you very much for watching!

«Reference Link»

Disclaimer: This is written after careful examination of researched information, but since it is privately operated & the source is often in English, there may be some mistranslated or incorrect information. Please understand that some information may be mistranslated or incorrect. Also, we may introduce Dapps, NFTs, and tokens in the articles, but we do not have any solicitation purpose. Please purchase and use all at your own risk.

Writer

mitsui@web3researcher

Daily information about web3 (projects, news, explanations of vocabulary, interviews with project owners, and articles about learning and thinking from research).

I run a web3 based Substack with over 1,000 subscribers in Japan. If you have a project that you would like to expand for Japan, please contact me on Twitter.

※This is a translation of a Japanese article, so I apologize for any unnatural English.