【Binance Research In-Depth Analysis ②】 Market Trends for DeFi, Stablecoins, NFTs, GameFi, and SocialFi in 2023

Good morning.

I am Mitsui, a web3 researcher.

Continuing from yesterday, I will explain the report "Full-Year 2023 & Themes for 2024" announced by Binance Research.

Part 1: Market Trends of Cryptocurrencies, L1, and L2 in 2023

Part 2: Market Trends of DeFi, Stablecoins, NFTs, GameFi, and SocialFi in 2023

Part 3: Funding Information, Institutional Investors' Movements, and 8 Areas of Focus in 2024, along with overall impressions and observations

This article is Part 2.

"Table of Contents"

1. DeFi Market in 2023

-Overall Market

-Liquid Staking

-Lending

-DEX

-Other areas of interest (LSTFi, RWA, Intent)

2. Stablecoin Market in 2023

-Overall Market

-Tether/USDT

-Circle/USDC

-MakerDAO/DAI

-Techteryx/TUSD

-Other areas of interest (CDP, LST Bags, Centralized)

3. NFT Market in 2023

-Overall Market

-NFT Marketplaces

-Other areas of interest (Product Innovation, NFT Perpetuals, Majors, Marketplace Mania, Bitcoin NFTs)

4. GameFi and SocialFi Markets in 2023

-Overall Market

-Full-Chain Games

-Entry of Major Game Companies

-SocialFi

DeFi Market in 2023

◼️ Overall Market

In 2023, DeFi's TVL (Total Value Locked) increased by 38.9% and reached $53.4 billion by the end of the year.

DeFi-related token prices also showed significant recovery with growth rates surpassing the overall market trends.

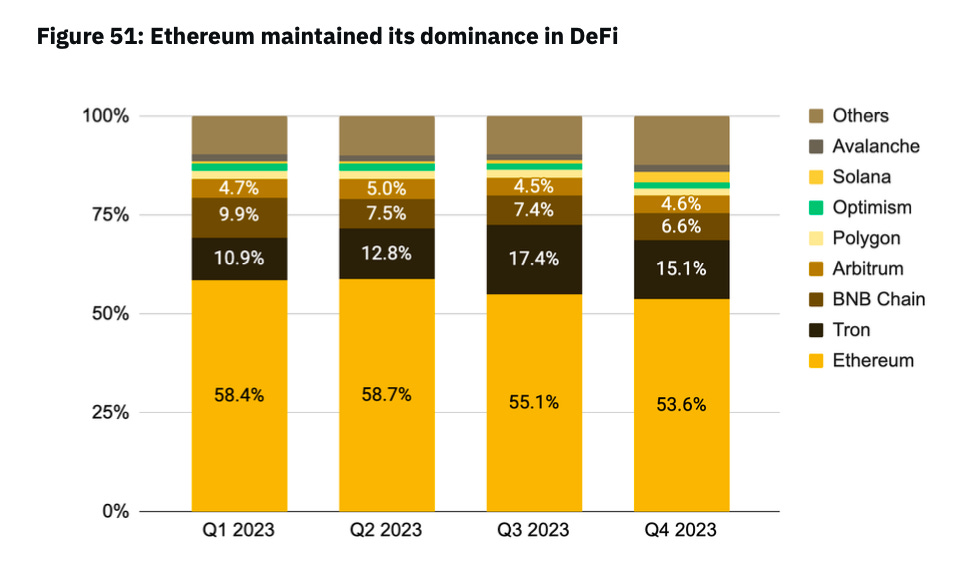

When looking at the TVL distribution by chain, it is clear that Ethereum continues to be the overwhelming leader by a wide margin.

Solana saw an increase in DeFi TVL from $210.5 million to $1.4 billion due to a sharp increase in token prices.

◼️Liquid Staking

The Liquid Staking protocol has emerged as a top DeFi subsector by TVL in 2023, surpassing DEX and lending protocols.

The successful transition to Ethereum's Proof of Stake and the ability to withdraw ETH after the upgrade to Ethereum 2.0 has accelerated the growth of staking and liquid staking.

With the Liquid Staking protocol, more users can participate in the staking process, reducing entry barriers and maintaining liquidity for staked assets.

The liquidity staking protocol on Solana has been experiencing a rapid increase in TVL over the past few months.

There is still significant room for growth in the Solana liquidity staking situation. Over 70% of Solana is eligible for staking, but the liquidity staking protocol represents less than 4% of that.

◼️ Lending

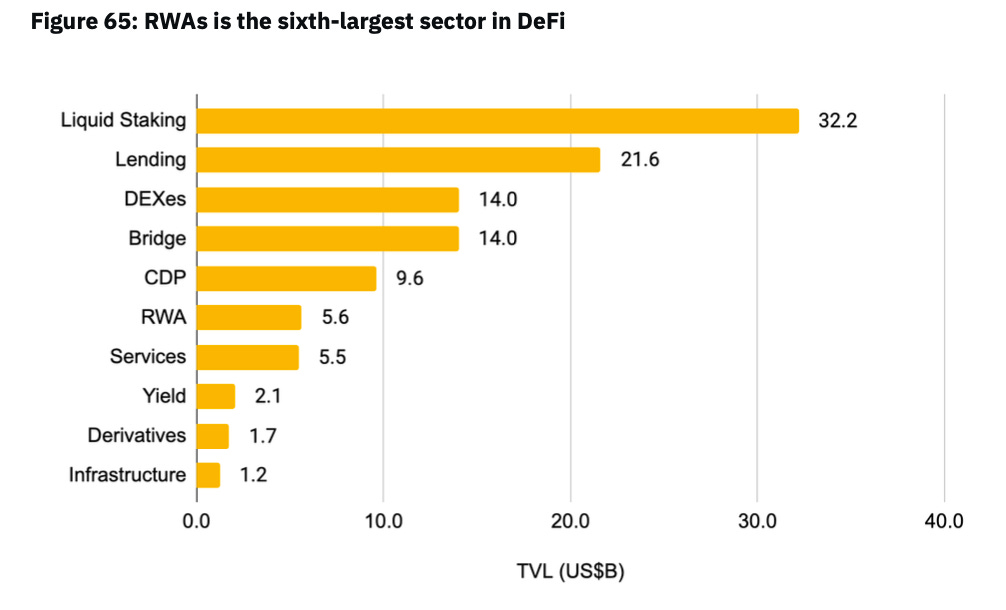

Lending is a crucial component of DeFi, with a TVL of $21.6 billion.

Notably, this sector has surpassed DEX to become the second-largest in terms of TVL.

A significant contributing factor to this is the increase in TVL driven by the lending protocol JustLend on the Tron network. In 2023 alone, JustLend's TVL has grown by 139% from $2.7 billion to $6.4 billion, making it the largest lending protocol in terms of TVL.

However, despite the high TVL of JustLend, the actual lending demand of the protocol is relatively low. Comparing borrowing amounts to available supply, the utilization rate of the protocol is less than 2%.

Overall, the average amount of active loans is increasing, and the monthly average amount of active loans in top protocols increased by 89% compared to the same month in the previous year in December 2023, showing a general upward trend throughout the year.

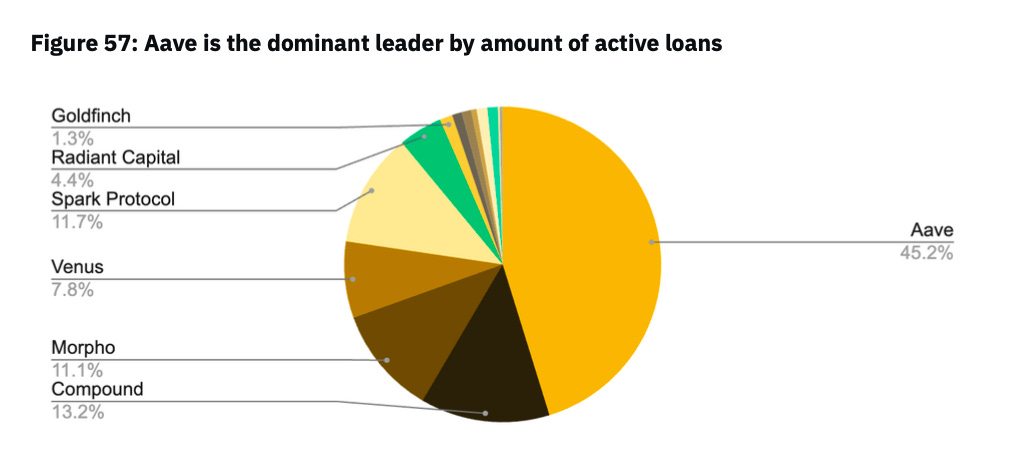

Aave stands out as the leader with the most active lending volume in the lending sector, accounting for just under half of the total active lending volume as of December 2023.

One notable development is the rapid growth of the Spark Protocol, which was launched just this May. It has now become one of the top lending protocols, currently ranking 4th in TVL (according to DeFi Llama) and 6th in average active loans (according to Token Terminal).

◼️DEX

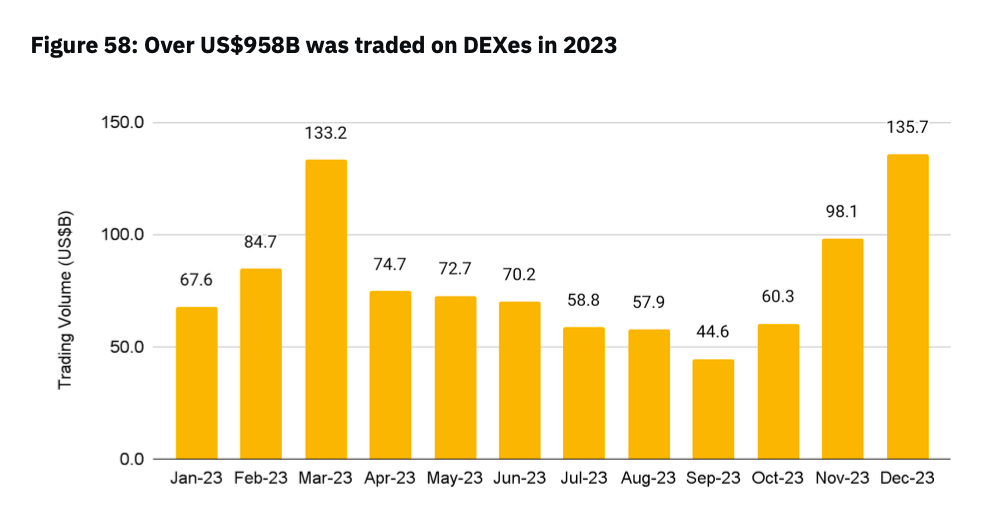

Except for the surge caused by regulatory concerns regarding USDC withdrawals and CEX in March, DEX trading volumes had been declining throughout the first three quarters of the year. However, in the fourth quarter, trading activity rebounded significantly along with an improvement in market sentiment.

DEX trading volume in 2023 surpassed $958 billion.

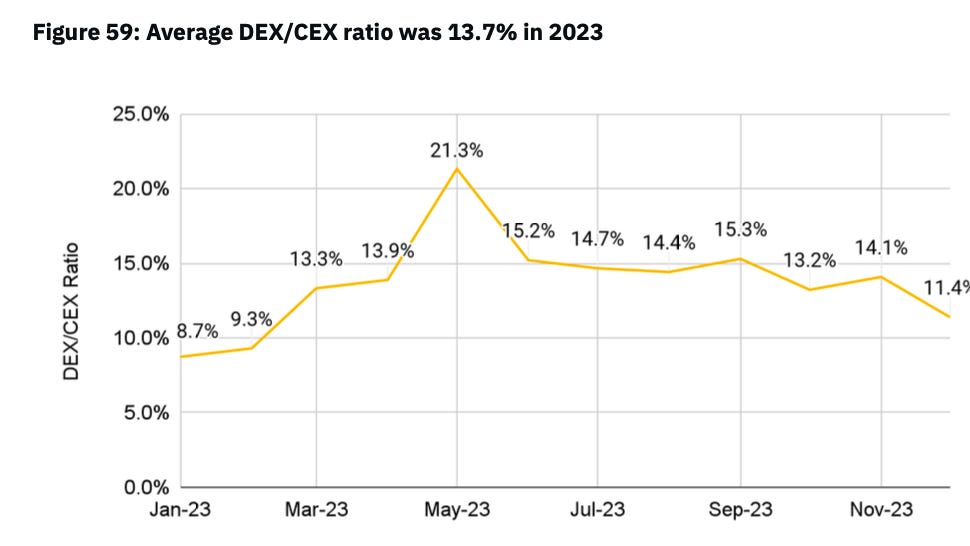

The DEX/CEX ratio, which indicates the trading volume of DEX compared to CEX, reached a record high of 21.3% in May 2023, significantly surpassing the 16.8% in January 2022. The average monthly DEX/CEX ratio in 2023 was 13.7%, an increase from 11.4% in 2022.

It is noteworthy that in the first quarter of 2023, the trading volume of Uniswap surpassed that of Coinbase for the first time, with Uniswap recording $155 billion in trading volume, compared to Coinbase's $145 billion.

Looking at the competitive situation, Uniswap has gained a market share of 56.3% in December 2023 and continues to be the largest DEX in terms of trading volume. The key developments this year include the announcement of Uniswap v4 and the launch of UniswapX.

PancakeSwap secured the second position and ended the year with a market share of 14.9%. It continues to be the most popular DEX on the BNB chain and is currently available on nine different blockchains.

◼️Other Areas of Interest

○LSTfi

LSTfi refers to a DeFi protocol built on top of Liquid Staking Derivatives.

The LSTfi protocol offers opportunities to generate additional yield, allowing LST holders to leverage their assets and maximize returns.

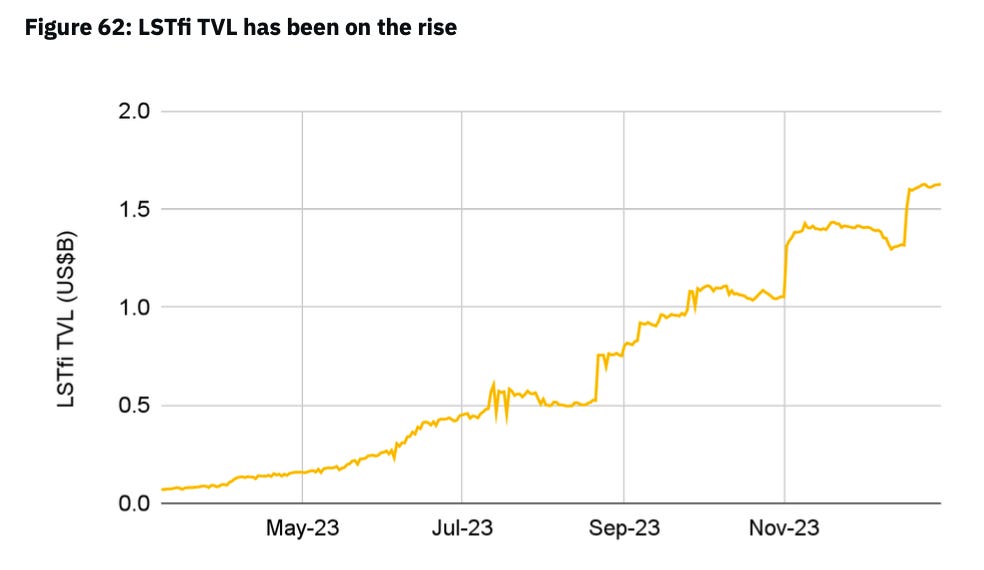

Benefiting from the adoption of Liquid Staking, TVL has rapidly increased over the past year.

The cumulative TVL of top LSTfi protocols has exceeded $1.6 billion, experiencing a 1,119% increase since the Ethereum Shasper upgrade on April 12th.

There are over $28.9 billion worth of LST on Ethereum, and the TVL of LSTfi protocols is approximately $1.6 billion, indicating a penetration rate of about 6%. Given this, such growth can be considered significant.

○RWA

By tokenizing RWA, it becomes possible to incorporate these off-chain assets onto the blockchain, opening up new possibilities for composability and potential use cases.

RWA is the 6th largest sector in DeFi according to DeFi Llama's tracking protocol, and it has seen a rapid rise from 13th place at the end of the second quarter.

Not all protocols are captured, and if tokenization is done on a private blockchain, it is possible that specific data may not be easily accessible, so the above data is likely to be conservative.

Nevertheless, the increasing rank of RWA as a sector is evidence of the growing adoption of the RWA protocol.

The tokenization of US bonds is gaining momentum.

It is estimated that tokenized assets will become a $16 trillion market by 2030.

This will be a significant increase from $310 billion in 2022 and will account for 10% of global GDP in 10 years.

○ Intent

Web3 activities are particularly challenging for beginners, and intent has recently gained attention as a solution for these users.

Intent refers to a signed message that allows users to express what they want to achieve on-chain.

Users delegate transaction creation to solvers, and solvers choose the optimal computation path on behalf of the user.

With intent, users can focus on their ultimate goals ("what") without being burdened by the specific steps ("how") to achieve those goals.

For example, it is possible to automatically perform transactions by searching for the optimal route among multiple DEXs using limit orders.

Stablecoin Market in 2023

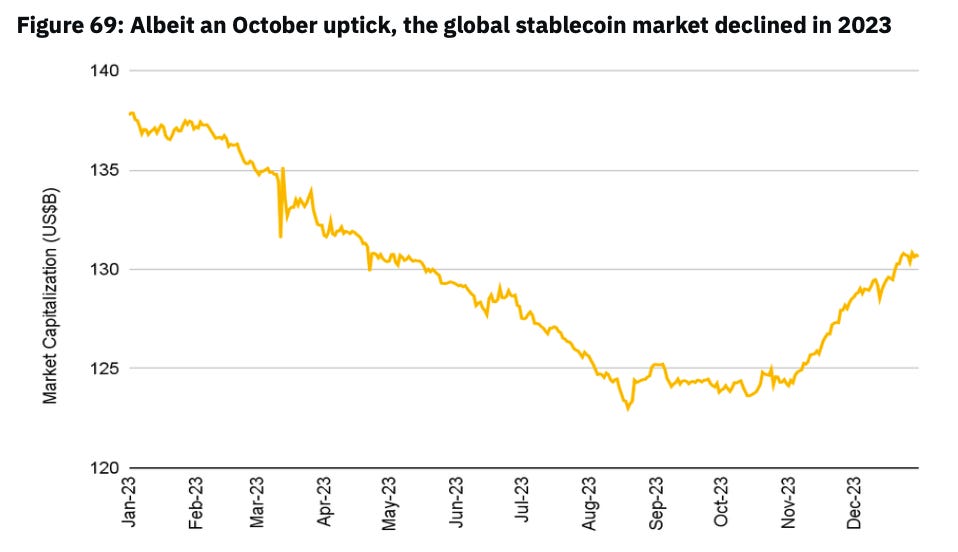

Although it has turned upward recently since October, the stablecoin market has generally been shrinking since the beginning of this year.

Currently, the market capitalization of stablecoins is approximately $130.6 billion, showing a slight decrease of 5.2% year-to-date from the $137.8 billion recorded at the beginning of 2023.

This decrease reflects the overall market slump that has affected both liquidity and trading volume.

Other factors include changes in regulatory environment, rising interest rates, discontinuation of Binance USD, and residual effects from events such as the FTX bankruptcy in November 2022 and the US regional bank crisis in March 2023.

Tether's USDT and Circle's USDC have continued to be the top two stablecoins in terms of market capitalization, but there have been significant changes in the overall market composition this year.

Tether's USDT has solidified its position in the market, with its market capitalization rising from over $66.2 billion at the beginning of the year to over $91.8 billion, reaching an astonishing 70.2% share in the stablecoin market.

USDC's market capitalization has decreased from $44.1 billion to $24 billion.

New entrants such as TrueUSD (TUSD) and First Digital USD (FDUSD) have emerged and successfully captured a 3.1% share of the global stablecoin market by leveraging market opportunities.

Centralized stablecoins continue to be the backbone of the industry, accounting for over 90% of the entire stablecoin market.

It is expected that centralized stablecoins will maintain their market dominance for the foreseeable future, but this year has seen the emergence of new players such as CDP (Collateralized Debt Position) stablecoins and LST (Liquid Staking Tokens) stablecoins.

◼️Tether/USDT

In 2023, Tether significantly strengthened its dominance in the stablecoin market.

Its market share increased from 48.1% in early 2023 to 70.2% in December, with a daily trading volume reaching $33.2 billion, surpassing its competitors by a large margin.

USDT has particularly expanded its user base globally and in developing countries, following the aftermath of increased regulations in the United States.

It has been found advantageous to shift crypto operations offshore to mitigate regulatory risks.

Users seeking to avoid uncertainties related to stablecoins partnered with US banks and the impact of regulations or bank failures have realized that USDT is becoming an increasingly attractive option.

The widening gap in the number of wallets holding balances of $1,000 or more between USDT and USDC further supports this evidence.

◼️Circle/USDC

The market value of USDC during its peak reached $55.2 billion, trailing closely behind USDT. However, its market share has now declined to 18.4%.

The reasons for this decrease are the changing regulatory environment, temporary downturn events, and this year's banking crisis, which have had a significant impact on the reputation, an important factor for stablecoin consumers.

Despite such setbacks, a bright spot for USDC is its continued leadership position in DeFi activities.

As the United States moves towards further clarifying the regulatory framework for stablecoins and cryptocurrencies in general, there is a possibility for a resurgence in momentum for US-based stablecoin issuers like USDC.

◼️MakerDAO/DAI

MakerDAO is one of the largest DeFi protocols.

DAI, with a market capitalization of $5.2 billion, rose to become the third-largest stablecoin in the market earlier this year, surpassing BUSD.

The success of DAI can be attributed to its expanded presence in the RWA market, competitive yields, and improved on-chain usability.

During the SVB crisis, DAI had a significant portion backed by USDC, but to mitigate future similar risks, DAI reduced its dependence on USDC and converted it to assets like U.S. Treasury securities.

This strategic shift helped diversify risks and improve yields.

Currently, MakerDAO holds over $2.5 billion in RWA exposure, generating more than half of its earnings.

This is the result of MakerDAO's strategic shift towards supplying funds through DAI loans backed by RWAs, aiming to generate additional income in the current high-yield environment.

◼️Techteryx/TUSD

After the discontinuation of BUSD, TUSD capitalized on the situation and gained popularity among users this year.

TUSD showed impressive growth with a YTD market capitalization increase of 201.4%.

On the other hand, TUSD has encountered regulatory hurdles, particularly with one of its providers, Prime Trust. The Nevada Financial Institutions Division ordered Prime Trust to halt deposits and withdrawals, temporarily suspending TUSD minting and impacting market sentiment.

Subsequently, Binance introduced favorable fees for other stablecoins like FDUSD, slowing down TUSD's growth in the second half of the year.

TUSD's market capitalization decreased from $3.4 billion to $2.3 billion since October.

◼️Other Areas of Interest

○Collateralized Debt Positions (CDP)

CDP stablecoins are loan contracts based on smart contracts, where users deposit assets such as ETH as collateral and receive loans denominated in stablecoins.

This allows users to secure liquidity without actually selling their held cryptocurrencies.

crvUSD by Curve and GHO by Aave are notable CDP stablecoins launched this year.

Both crvUSD and GHO, despite being in operation for less than a year, are expected to experience significant growth surpassing their current circulating supplies.

○LST Bags

In 2023, LST-backed stablecoins such as eUSD by Lybra and mkUSD by Prisma emerged.

These stablecoins are collateralized by LST, providing holders with the dual benefits of maintaining the essential characteristics of stablecoins while earning yields.

As the amount of ETH staked increases, the total addressable market for these stablecoins also grows accordingly.

○Centralized

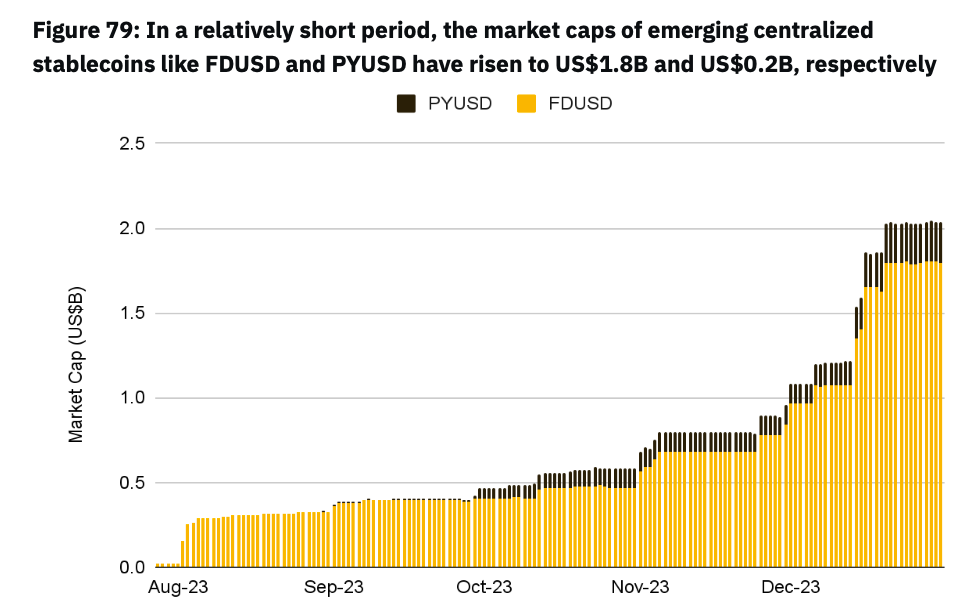

FDUSD by First Digital and PYUSD by PayPal are centralized stablecoins that quickly gained significant market share.

Despite being relatively newer compared to other emerging decentralized models, both stablecoins have surpassed them in terms of market capitalization.

This highlights the dominance of centralized stablecoins and underscores the benefits of integrating with centralized liquidity sources.

FDUSD has reached a market capitalization of $1.8 billion, making it the fifth-largest stablecoin.

PYUSD's circulating supply of 234.1 million tokens propelled it to become the 11th largest stablecoin.

NFT Market in 2023

◼️ Overall Market

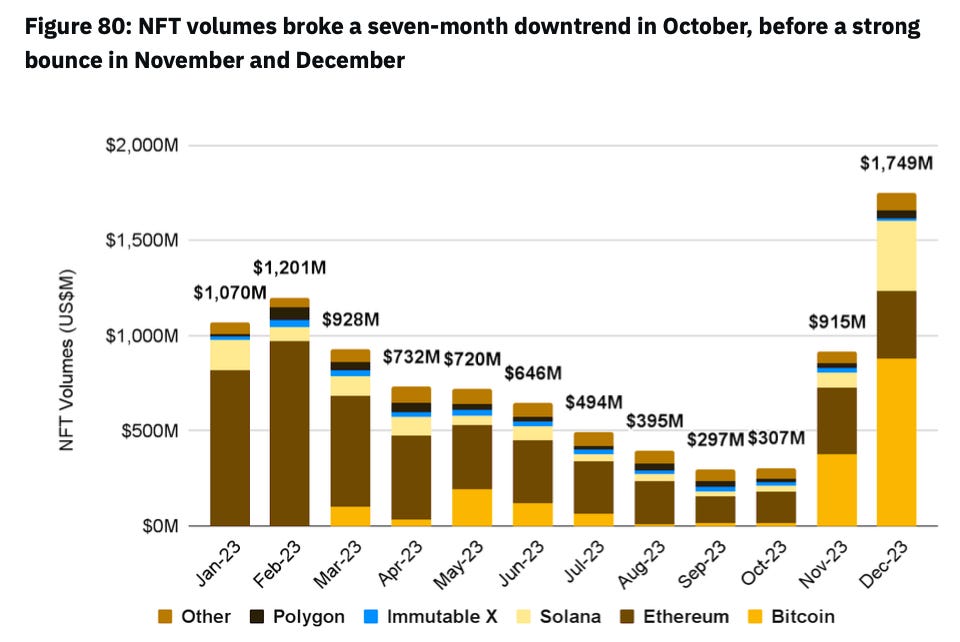

After a decline in excitement from March to September, the market recovered in the fourth quarter.

The trading volume of the top 15 chains initially peaked at over 1.2 billion US dollars in February but then experienced a downward trend for seven months. However, it collapsed in October and showed a significant rebound in November.

This rebound led to a substantial increase, setting a new record for annual trading volume in December 2023.

When looking at the top chains of NFTs, Ethereum has maintained a significant lead in sales volume (about 10 times higher than the second chain) and has been the most popular chain throughout most of the year.

However, in 2023, a new player entered the NFT world, Bitcoin.

Strictly speaking, it is not an NFT, but the sale of BRC-20 tokens is still considered part of the Bitcoin NFT market and has had an impact on the trading volume of Bitcoin NFTs.

Solana NFTs have also been performing well, benefiting from the positive momentum towards the chain in recent months. NFT sales in December exceeded $366 million, reaching a new high in the past two years and significantly surpassing the annual average of $70 million.

◼️NFT Marketplaces

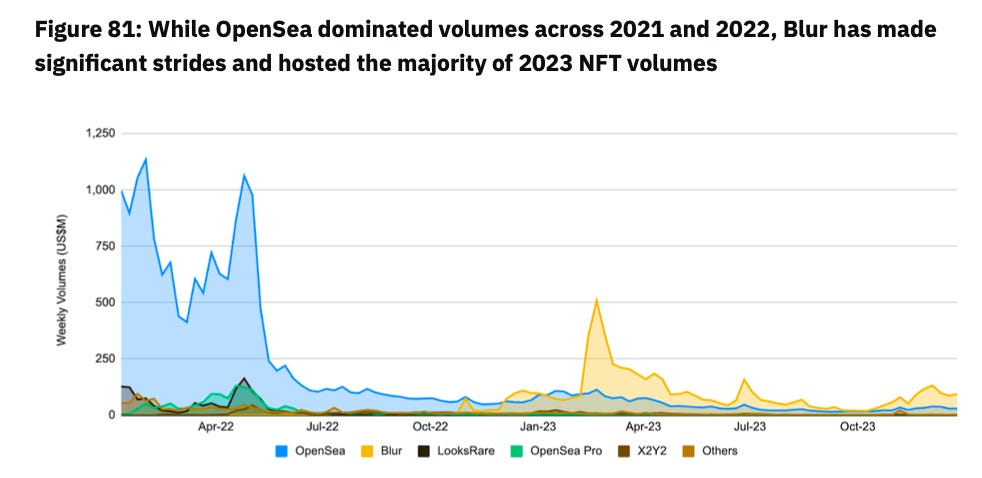

One of the important themes in the NFT market in 2023 was the NFT marketplace war.

OpenSea, which was the initial leader, lost the battle against the new entrant, Blur, and the balance of power shifted.

OpenSea has been the dominant leader throughout the booming periods of the NFT market in 2021 and 2022, while other marketplaces such as LooksRare and X2Y2 were launched in 2022, aiming to gain market share using vampire attacks but were unable to take a significant share away from OpenSea.

Only Blur was able to achieve this and currently holds the top position.

○OpenSea

OpenSea's NFT market share decreased from 85% in January 2022 to 41% in January 2023 and ended the year at less than 23%.

Additionally, there were news reports of over 50% of the company being laid off and a decrease in valuation from VCs, making 2023 a challenging year for OpenSea.

To maintain its position, OpenSea continued to innovate throughout the year and announced numerous new products.

These include the NFT marketplace aggregator, OpenSea Deals for NFT swaps, and OpenSea Studio for creators to create, launch, and manage their own collections in a no-code environment.

In the future, OpenSea may also consider token airdrops and the creation of NFT-focused Layer 2 solutions like Blur.

○Blur

Blur gained significant attention since its launch and dominated NFT-related discussions in 2023.

Blur focuses on "pro traders" and introduced many features to cater to this audience.

The launch of $BLUR as part of multiple rounds of airdrops was highly effective in acquiring and retaining customers.

The recent announcement of Blast, an Ethereum Optimistic L2 led by the same team behind Blur and founded by Pacman, was an interesting development.

○Tensor

Tensor is a leading NFT marketplace on Solana and experienced strong success and growth throughout 2023, surpassing Magic Eden as the top Solana NFT marketplace.

Particularly in the fourth quarter of 2023, as the Solana narrative grew, Tensor performed well.

Tensor has a sophisticated trading interface similar to Blur and also shares a trading-oriented atmosphere.

○Magic Eden

Magic Eden, operating since 2021, is active in the Solana, Polygon, and Bitcoin NFT markets.

Shortly after the frenzy around the first Ordinals, Magic Eden became one of the first major NFT marketplaces to add Bitcoin NFT functionality.

Magic Eden also announced partnerships with Yuga Labs, the operators of Bored Ape Yacht Club, CryptoPunks, Meebits, Otherside, and other collections, with plans to launch the Magic Eden ETH NFT Marketplace that respects creator royalties.

○Zora

Zora is an NFT protocol and marketplace that supports NFT creation and trading by creators.

Zora operates one of the first NFT marketplaces launched on its own chain, the Zora Network on the OP Stack L2 chain.

◼️Other Areas of Interest

○Product Innovation

The era of PFPs is becoming more than just the future of NFTs; it is becoming a presence throughout the entire cycle.

An example is Pudgy Penguins, which initially released a physical toy set alongside their NFT collection and is now sold in over 2,000 Walmart stores across the US.

Recently, they launched Pudgy World, an on-chain game that integrates both NFTs and physical toys.

○NFT Perpetuals

The rise of Blur and Tensor indicates the existence of promising customers for "pro trading" NFTs with sophisticated interfaces.

Existing companies in the current market include Sujiko, which launched its mainnet in the fourth quarter of 2023, and nftperp, which is currently in the testnet and recently announced a $3 million Series A funding round.

○Metrics

CryptoPunks and Bored Apes continue to dominate the charts, but looking at sentiment on Twitter, it appears that Punks are slightly holding more value.

○ Marketplace Mania

Blur changed the NFT trading market last year, and despite several strategic changes, OpenSea has still faced challenges. OpenSea still holds the potential for attractive tokens and L2, both of which could have a significant impact on its market position.

The NFT market on Solana is still experiencing rapid growth, with great room for expansion, making the battle between Tensor, Magic Eden, and small or new players noteworthy.

○ Bitcoin NFTs

Ordinal, Inscription, BRC-20 tokens, all of these surprised the market last year, reaching unprecedented levels of interest.

Bitcoin NFTs are an appealing and intriguing market that continues to require attention.

GameFi and SocialFi Markets in 2023

◼️ Overall Market

The game sector is led by the top three blockchains. Over 64% of games are built on BNB Chain, Ethereum, and Polygon.

The blockchain gaming industry often receives criticism for having low game quality and inferior gameplay. However, it is important to understand that even traditional leading game studios with decades of game development experience take many years to develop high-quality games.

Currently, only 27.8% of all blockchain gaming projects are operational, while the rest are still in various stages of development.

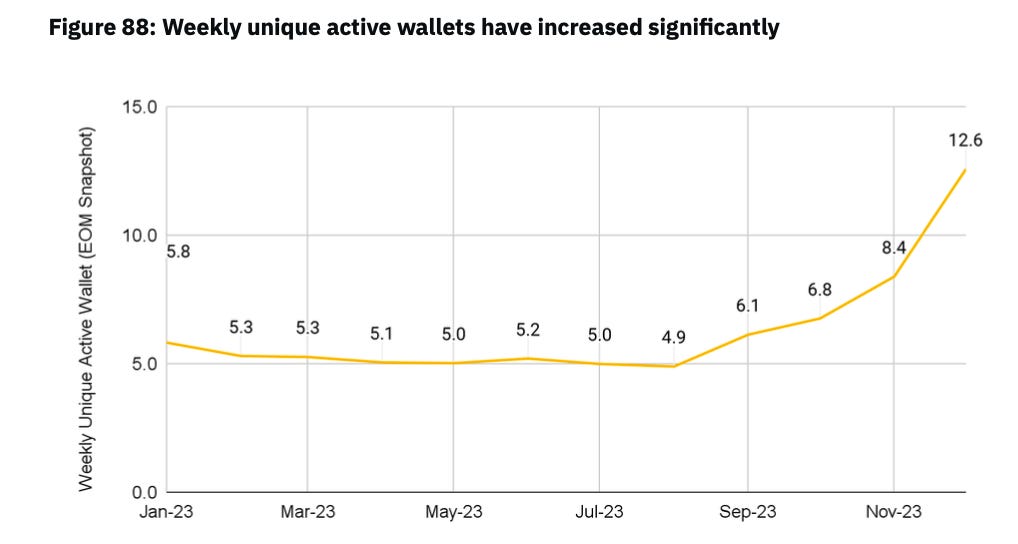

On-chain indicators show a revival of gaming activity towards the end of the year.

The first three quarters of 2023 were relatively quiet, but weekly unique active wallets based on the end-of-month snapshot have rapidly increased in the last few months of this year.

◼️Full On-Chain Games

Full on-chain games offer significant advantages such as immutability and game persistence, composability and interoperability, true ownership of digital assets, and community governance, which instill great expectations for the future of blockchain games.

Among blockchain games, full on-chain games account for less than 10%.

Looking ahead, the outlook for on-chain games is optimistic. The potential of immersive game experiences characterized by a more interoperable ecosystem of games and assets, and deep integration of blockchain technology, paints a promising future for the growth of this field.

◼️Entry of Major Game Companies

Major game companies are entering the blockchain game industry, and several games by renowned game publishers are scheduled to be released in 2024.

The entry of major game publishers into the blockchain game is a positive development and indicates the recognition of the value behind blockchain games.

◼️SocialFi

○ Growth of Firiend .tech

By leveraging blockchain technology, web3 social applications have enabled characteristics such as decentralization, composability, and ownership.

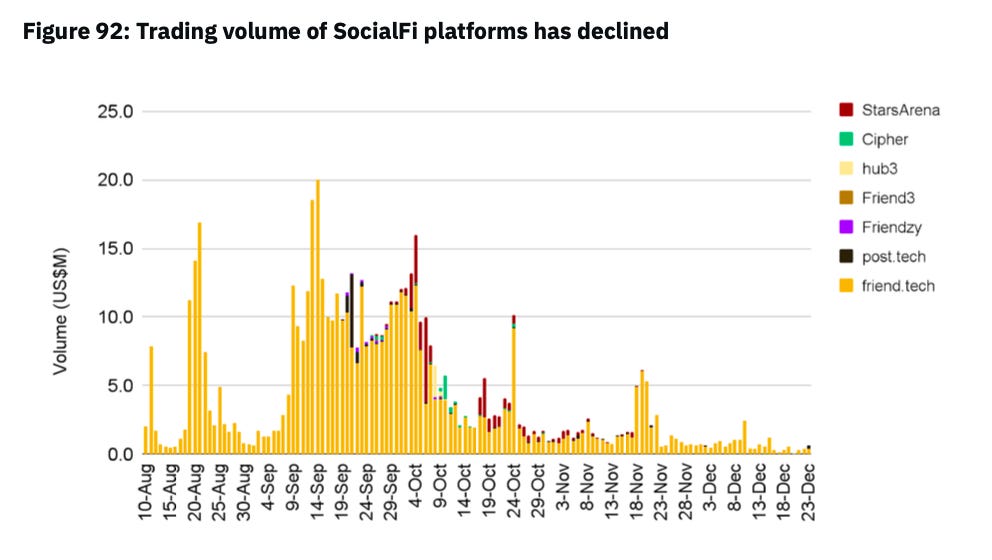

In 2023, SocialFi experienced rapid growth with the launch of Friend.tech and its forks.

However, despite a promising start, trading on the SocialFi platform has generally declined along with a decrease in interest.

Trading activities have been decreasing since October, and although daily trading volume reached $20 million in September at its peak, it fell well below the $1 million mark in December.

It is still unclear whether the interest and activity of the SocialFi platform, especially friend.tech, will revive or not.

○ Growth of Farcaster

Farcaster transitioned to a permissionless model in October 2023, opening registration to all users and allowing more users to access the platform.

Since the transition to the OP mainnet and permissionless model, Farcaster has witnessed a revival in user activity.

Farcaster currently has 47,000 registered users, and it still has a long way to go before reaching the scale of existing giant social media platforms like X, which is said to have over 300 million users. Web3 social still has a long journey ahead.

○ Announcement of Lens v2

Lens v2 will be launched on the mainnet in November 2023, with activities and interactions transitioning from address-based to profile-based, improving the developer experience except for the following:

Notably, Lens v2 integrates ERC-6551, allowing profiles to function as wallets.

Lens v2 introduces "Open Actions" to enhance composability.

This allows Lens applications to directly execute external actions on Lens, enabling users to perform such actions without leaving the Lens ecosystem, resulting in a better user experience.

○ Summary

Web3 social is a promising alternative to existing social media platforms.

Users benefit from greater control, potential monetization opportunities, and higher composability.

The rapid growth of friend.tech demonstrates significant interest in SocialFi and the willingness to explore innovative applications that combine community engagement and monetization elements. However, the subsequent decrease in activity highlights the challenges of SocialFi.

We are still in the early stages of web3 social development, and there is still a long way to go to achieve mass adoption.

Nevertheless, the fundamental benefits of user-centric and censorship-resistant social landscapes provide an optimistic outlook for the future.

That concludes the middle part.

Although it has become quite lengthy, I hope this article provides an understanding of the overall picture of various markets. Through my own research, I have gained an understanding of the current state of each market. The final part will be released tomorrow, so please look forward to it! (If you haven't read the first part yet, please do.)

Part 1: Market Trends of Cryptocurrencies, L1, and L2 in 2023

Part 2: Market Trends of DeFi, Stablecoins, NFTs, GameFi, and SocialFi in 2023

Part 3: Funding Information, Institutional Investor Activities, 8 Areas of Focus in 2024, and General Impressions and Considerations throughout 2023

Reference & Image Source: "Full-Year 2023 & Themes for 2024"

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

A web3 newsletter delivered in five languages around the world. We deliver various articles about web3, including project explanations, news and trend analysis, and industry reports, every day. You can subscribe for $8 per month ($80 per year) and receive research articles that took 100 hours to complete every day.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.