Good morning.

I'm mitsui, a web3 researcher.

Today, I will explain the report "Full-Year 2023 & Themes for 2024" recently announced by Binance Research. I have read the 140-page report and summarized its overview.

Since it was a very long report, the explanatory articles will be divided into three parts: "Part 1," "Part 2," and "Part 3," and will be updated for three consecutive days.

Part 1: Market trends for the overall cryptocurrency, L1, and L2 in 2023

Part 2: Market trends for DeFi, stablecoins, NFTs, GameFi, and SocialFi in 2023

Part 3: Fundraising information, institutional investors' movements in 2023, 8 areas of focus for 2024, and overall impressions and observations

This article is Part 1.

"Table of Contents"

1. The Overall Market in 2023

2. The L1 Market in 2023

-Bitcoin

-Other L1s

3. The L2 Market in 2023

-The Overall Market

-Optimistic Rollup Market

-zk Rollup Market

-Other Notable Trends

Market Overview for 2023

The cryptocurrency market in 2023 experienced significant growth, driven by substantial increases in the first and fourth quarters, resulting in a market capitalization increase of 109%.

In the last quarter, there was a sharp increase in the price due to expectations of the approval of Bitcoin ETFs and the Bitcoin halving.

Additionally, the broad financial environment characterized by the resilience of global GDP growth rates and low inflation rates contributed to the promotion of risk assets like cryptocurrencies.

A major disruption occurred in March when prominent banks collapsed (such as the Silicon Valley Bank), which also had a ripple effect on the cryptocurrency market and temporarily halted trading of USDC.

Although there were temporary declines due to regulatory measures and global economic trends, the prices quickly recovered, making it a year of overall growth.

L1 Market in 2023

◼️Bitcoin

○Rising Market Dominance

The emergence of Ordinals, Inscriptions, and BRC-20 tokens ushered in a new era for Bitcoin.

As a result, Bitcoin's market dominance increased from 40.4% to 50.2%, now accounting for more than half of the total market capitalization of the cryptocurrency market.

○ Relationship with TradFi

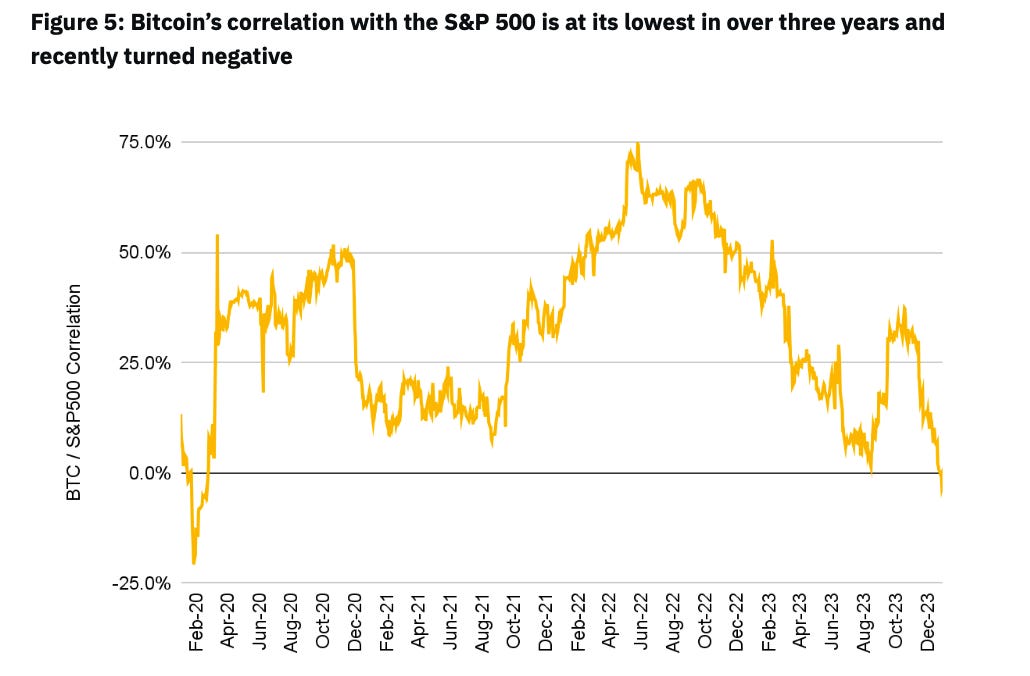

In the past, the correlation between Bitcoin and the S&P500 has fluctuated between -20% and 20%, but since mid-2020, there has been a significant correlation of around 50%.

In 2023, this correlation has finally turned negative.

As a result, the debate about Bitcoin being an effective diversification factor in portfolios has resurfaced.

When comparing the performance of Bitcoin with other TradFi investments, Bitcoin emerged as the top performer with a 159% increase overall last year. While Alphabet and Amazon stocks were the only stocks that saw an increase of over 50% last year in comparison, they still fall far behind Bitcoin.

○ The Arrival of a New Era for Ordinals and Inscriptions

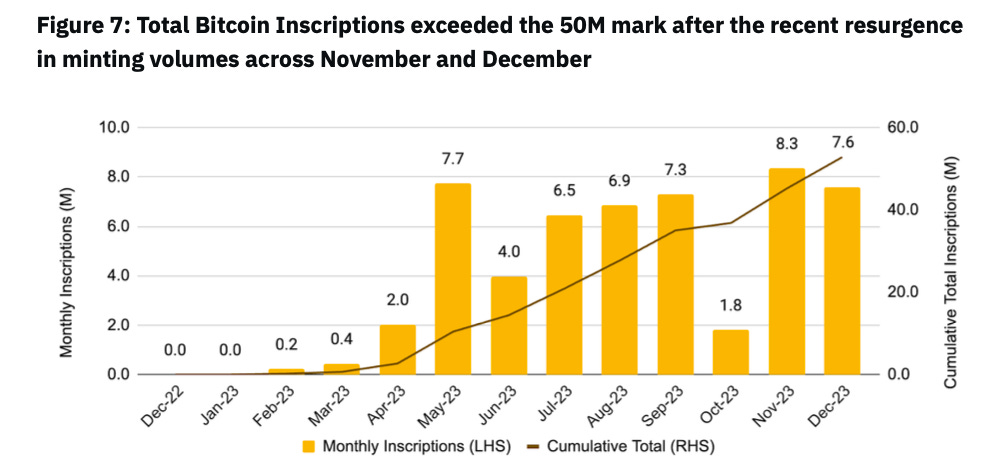

One of the most significant developments for Bitcoin in 2023 is the introduction of Ordinals and Inscriptions.

The first Inscription was minted in December 2022 and has since experienced explosive growth since the introduction of BRC-20.

The current number of Inscriptions has exceeded 50 million, generating fees surpassing 230 million US dollars.

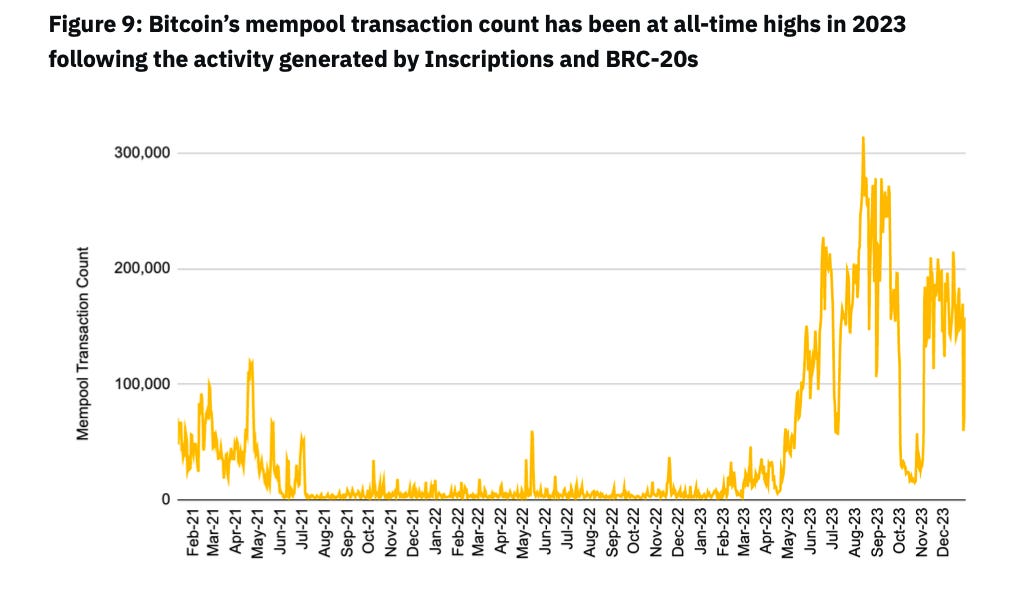

As a result, the number of transactions in the Bitcoin transaction pool has reached an all-time high in the market.

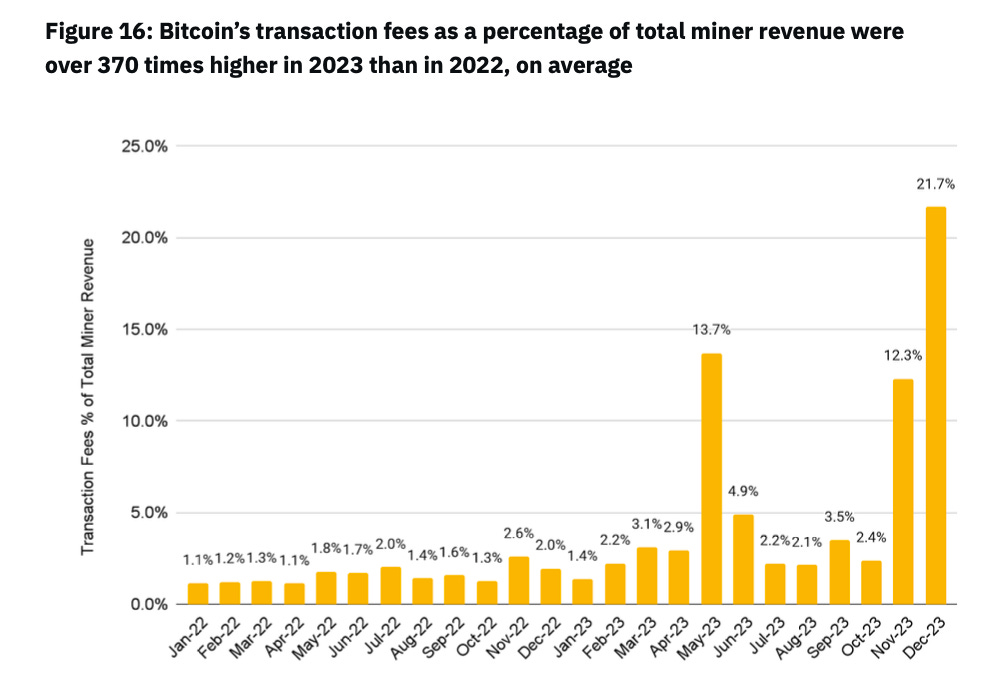

This situation has generated mixed opinions, but many miners welcomed the surge in Bitcoin transaction fees as it alleviated the incentive decline caused by the halving of block rewards.

Eventually, block rewards will be reduced to zero, and miners' only source of reward will be Bitcoin transaction fees. Therefore, the discussion on activating the Bitcoin ecosystem through Ordinals became crucial and revolutionary.

It is evident that transaction fees have increased from an average of 1.6% of total miner rewards in 2022 to over 5.5% in 2023.

In 2024, it is expected that there will be a influx of funds through ETFs, development of Bitcoin's L2 and zk-rollup solutions, and advancements in Ordinals.

◼️Other L1s

Ethereum continues to maintain its strength in all aspects as before.

In 2023, ETH experienced a surge in liquidity staking, the advancement of L2 rollups, and the progress of modular blockchains.

In 2023, BNB announced BNB Greenfield, the next-generation data storage platform, as well as opBNB, an Optimistic L2 BNB chain based on the OP stack, contributing to the continuous growth of its ecosystem. The DeFi sector remained strong.

SOL played a central role among L1 networks in 2023. With protocol updates, there was only one network halt. Additionally, the advancement of DePIN and DeFi protocols led to a price surge through airdrops.

AVAX made significant progress in 2023 through subnets and partnerships with gaming and RWA sectors in particular.

L2 Market in 2023

◼️Overall Market

One of the most thriving areas in 2023, with a TVL (Total Value Locked) increase of over 321.3% within a year.

The percentage of L2 in daily trading volume has risen to 72% compared to ETH.

The emergence of RaaS services is further accelerating this trend.

Throughout the year, the average L2 TPS has consistently increased, reaching an average TPS of 73.2 for L2 by the end of 2023. The average for Ethereum is 12.3.

The increase in the number of users is also evident, with L2 surpassing 500,000 daily active addresses, which is 63.6% higher than Ethereum.

Furthermore, the fees paid when committing data from L2 to ETH have recorded a dramatic increase of 453.8% annually.

This indicates the activation of L2.

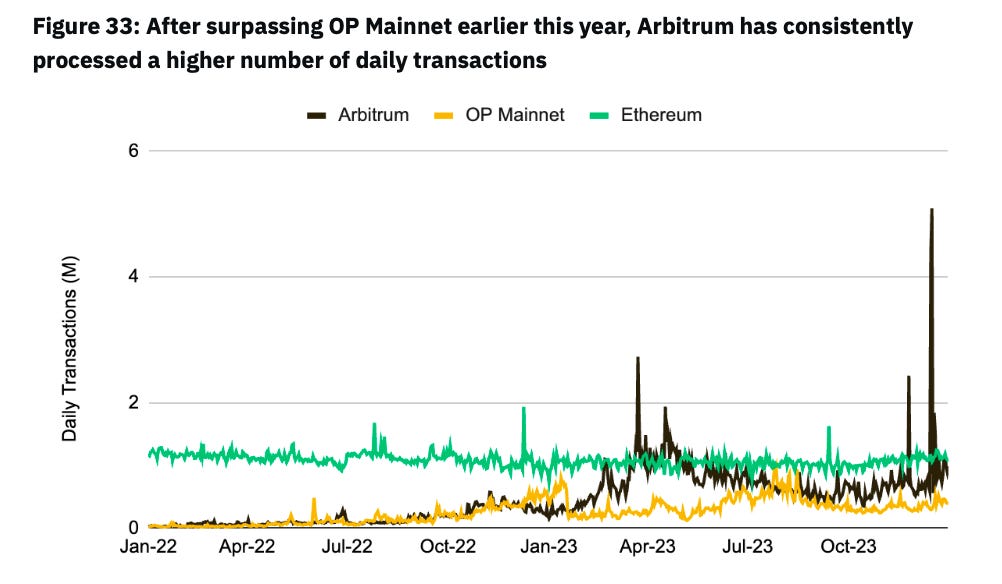

Among the types of Layer 2 solutions, Optimistic Rollup continues to dominate a significant share.

However, in 2023, zkEVM solutions such as zkSync Era, Polygon zkEVM, Linea, and Scroll finally emerged.

zk Rollup has its advantages, but it still falls far behind Optimistic Rollup in terms of market share. However, there is ample potential for it to change in the future.

Additionally, in 2023, L2s with native yields such as Blast and Manta Network have energized the market, but it is uncertain whether this trend will continue.

This is not just a technical foundation of L2, but merely a provision of yields and one of the strategies.

While there are L2s that focus on technological specialization and those that focus on sales, L2s have essentially assumed similar mission statements, resulting in similar concepts and a saturated market.

It is expected that they will be integrated in the future.

◼️ Optimistic Rollup Market

○ Arbitrum

Achieved success in 2023, solidifying not only L2 but also the entire blockchain ecosystem.

Among the multiple new entrants in this year, it gained a significant market share of 47.7% in the L2 market and continues to have the highest TVL (Total Value Locked).

Recorded an average of 1.487 million daily active addresses, surpassing the 709,000 addresses on the OP mainnet by a large margin. In terms of daily transaction volume, Arbitrum exceeded 1.1 million transactions, surpassing the 4,000 transactions on the OP mainnet.

Notable events in 2023 include the launch of native token airdrops, the announcement of the L3 building kit Arbitrum Orbit, the surge of DeFi, the user-centric campaign Arbitrum Odyssey, and the implementation of incentive programs for the ecosystem.

Arbitrum's revenue will exceed 16 million USD in 2023.

○Optimism

As the second major Optimism Rollup, it boasts over 6.3 billion USD TVL and holds a substantial market share of 31.1%.

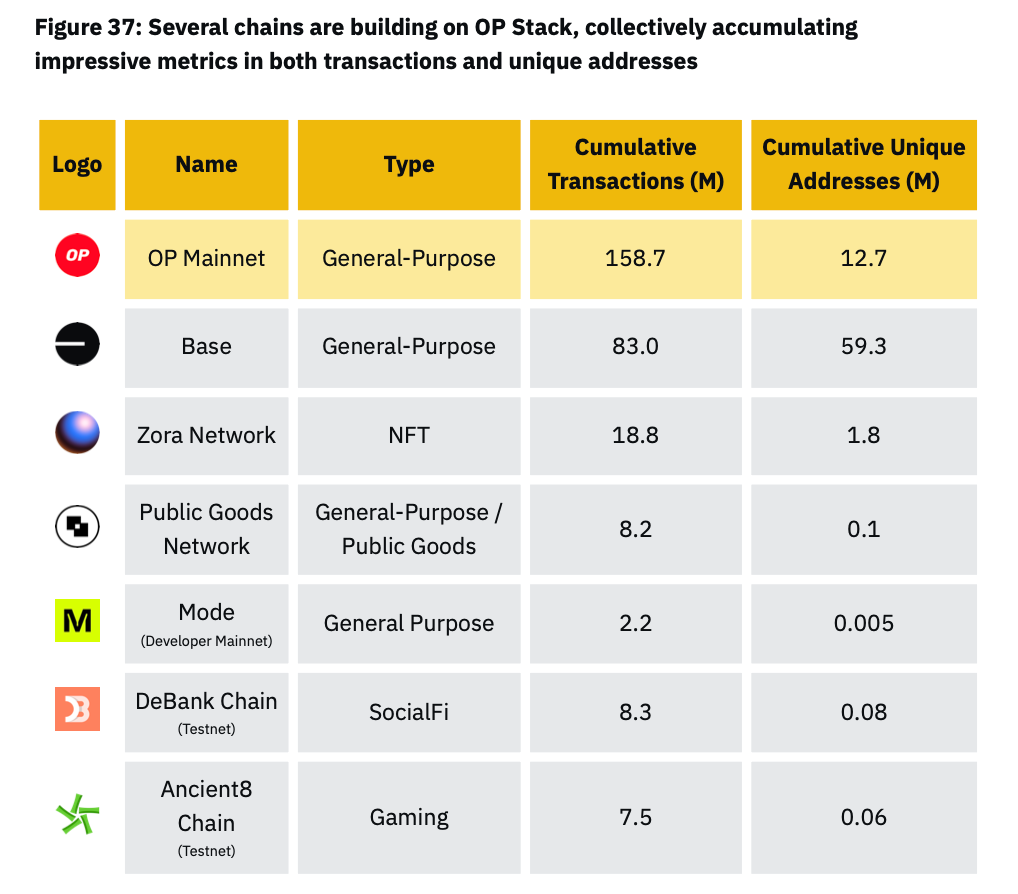

2023 marked a significant turning point with the introduction of the Superchain concept and the OP Stack.

Other notable events include the migration of major L2 rollups to Bedrock, improving operations and user experience, funding retroactive public goods, and conducting the third OP airdrop.

Particularly, the growth of Base has been remarkable, as Optimism generated over 10.3 million USD in profit this year, with Base contributing over 13% of the overall on-chain profits since its launch in July.

○Base

Base is an L2 solution built by Coinbase using the OP Stack.

As a general-purpose L2 and the second most popular OP Stack chain after the OP mainnet, Base boasts a TVL of $628 million, making it the fourth largest TVL among L2s.

The launch of Base was particularly successful and accompanied by a series of notable events that not only increased liquidity but also laid a crucial foundation for L2.

The launch event, known as "Onchain Summer," took place over one month and coincided with the mainnet of Base, where NFTs in collaboration with partners like Coca-Cola were announced.

During this event, over 268,000 unique wallets minted over 700,000 NFTs across 75 collections.

Over 100 dApps were created, with friend.tech playing a significant catalyst.

After the initial excitement in August and September, friend.tech experienced a significant decrease in daily transaction volume for the remainder of 2023.

Ultimately, friend.tech demonstrated the importance of incorporating dApps designed specifically for retail users, such as SocialFi, in the early stages of L2 adoption.

Other L2 solutions could adopt a similar strategy and potentially drive growth by onboarding such dApps.

○opBNB

Founded with the goal of achieving over 4K TPS and transaction fees below 0.001 USD, opBNB is an EVM-compatible chain that currently records approximately 54.3 TPS and transaction fees around 0.09 USD, a significant improvement compared to the BNB chain.

In relation to the BNB chain, opBNB positions itself to support high-throughput dApps, similar to games.

While still in its early stages, opBNB has reflected a growth of 660.3% since the mainnet launch and has collected over 29.2 million USD in bridging assets.

As a result, it processed over 313.4 million transactions with 2.2 million unique active addresses in 2023.

As a dedicated L2 solution for the BNB chain, aiming to achieve an astonishing 10K TPS while reducing transaction costs to one-tenth of the current level, opBNB addresses scalability issues not as problematic as Ethereum.

◼️zk Rollup Market

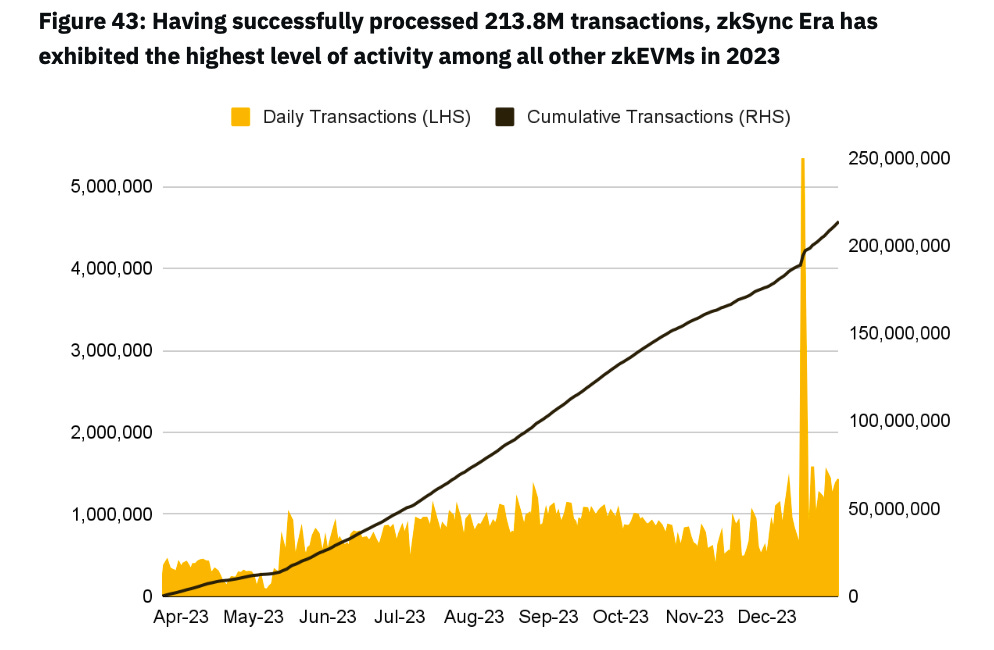

○zkSync Era

As the first zkEVM solution launched on the mainnet, it achieved a significant milestone earlier this year.

Currently, it boasts a TVL of over 570 million USD and has processed over 213.8 million transactions, the highest among zkEVM solutions.

Additionally, zkSync Era surpassed both OP Mainnet and Arbitrum in a short period and became the largest fee payer for Ethereum data publishing during a specific month of the year.

Daily transactions have steadily increased throughout the year, reaching a peak of 5.3 million transactions mainly driven by activity based on Inscription on December 16, 2023.

Due to this surge in transactions, zkSync Era achieved a maximum TPS of 62.1 in a day, setting a new record among L2 solutions.

However, it should be noted that the current user base is largely driven by expectations of airdrops, and the Dapps portfolio is still limited due to the concentration of funds in the DeFi sector. This indicates that the ecosystem is still in its early stages of development.

Nevertheless, zkSync Era has been the most profitable L2 solution this year, generating revenue of over $22.6 million.

zkSync has released its proprietary modular roll-up development framework, ZK Stack, and is also focusing on horizontal expansion to enable anyone to deploy roll-up solutions.

○StarkNet

StarkNet is a permissionless ZK-Rollup on Ethereum that uses the Cairo programming language and Cairo virtual machine, both optimized for STARK proofs.

Despite being less hyped than other L2 solutions, StarkNet has seen steady growth, with a TVL reaching $146 million.

Notable developments this year include the deployment of StarkNet's Quantum Leap upgrade, introduction of StarkNet Appchains, Devonomics Pilot Program, and announcement of the STRK token distribution plan.

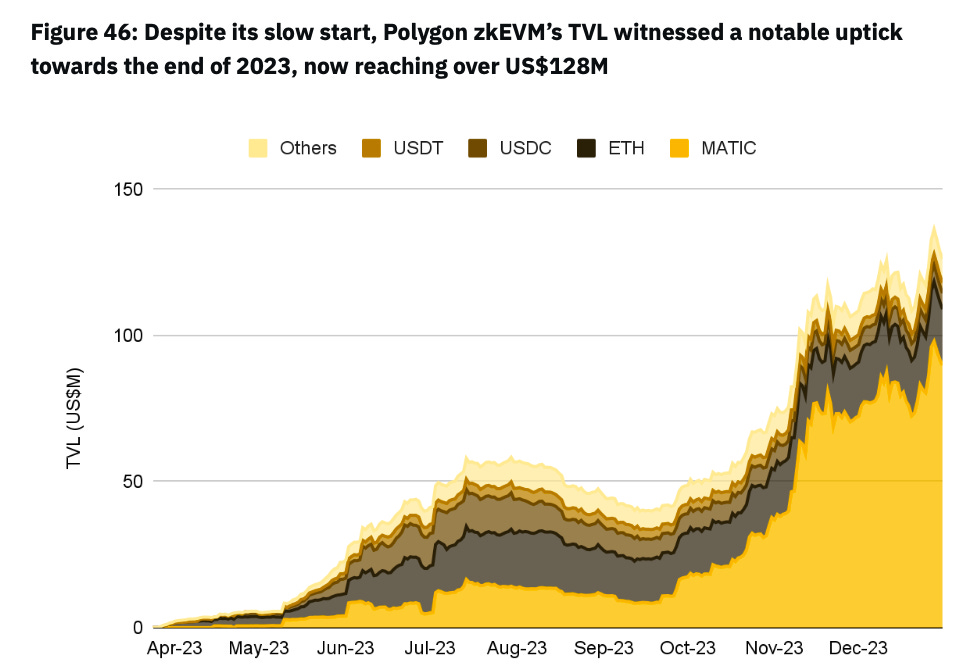

○Polygon zkEVM

In 2023, Polygon made significant progress in the ZK field, with the Polygon zkEVM roll-up solution at its core.

The initial growth of Polygon zkEVM was relatively slow compared to its competitors in the zkEVM space, but it picked up momentum in the second half of 2023, surpassing $128 million in L2 TVL and attracting over 100,000 depositors.

Additionally, significant events included the relaunch of Polygon Bridge supported by a large grant program exceeding 110 million MATIC and the announcement of Polygon 2.0, which includes significant governance changes.

Moreover, the announcement of Polygon CDK has made a major impact, as it has deployed an ecosystem where anyone can easily build L2 chains in the zkEVM market.

○Linea

ConsenSys released Linea zkEVM on the mainnet.

It rapidly gained popularity, reaching a TVL of $186 million.

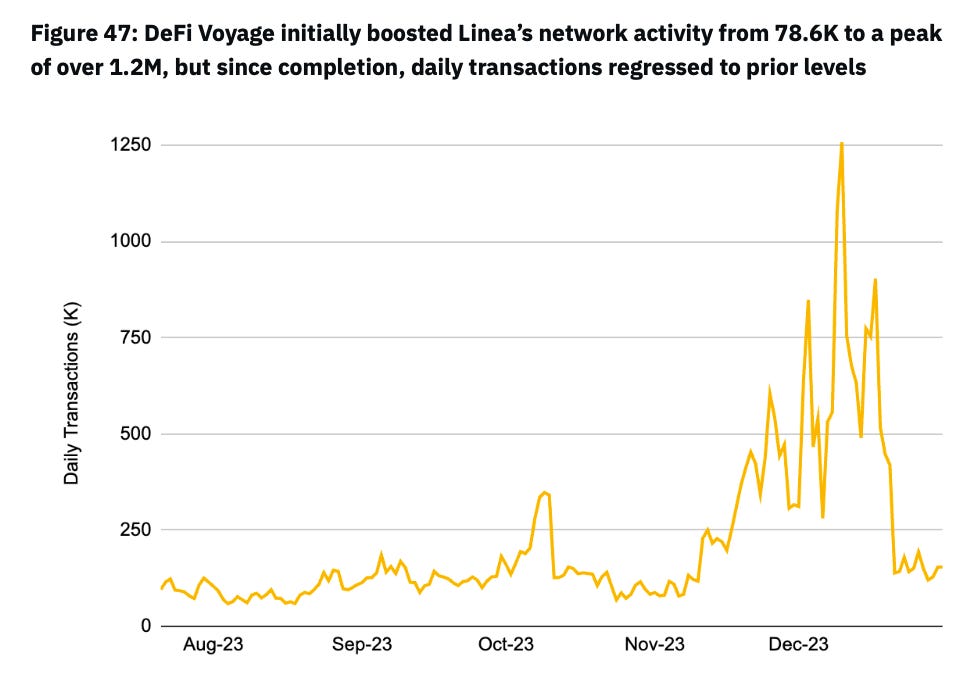

To acquire new users after the mainnet launch called DeFi Voyage, the first large-scale campaign was executed. It was designed to grant SBT and provide incentives for users to explore and engage with various dApps on the Linear Network.

Although this campaign and airdrops resulted in rapid growth initially, it has since experienced a sharp decline, and the future development is uncertain.

○Scroll

After more than 2 years of development, Scroll launched its mainnet on October 17th.

As a Type-2 zkEVM, Scroll seamlessly integrates with Ethereum at the bytecode level, simplifying the deployment of existing infrastructure and dApps.

Unlike other L2 strategies, Scroll prioritized building a product that is closer to EVM in terms of functionality through careful development.

However, it is a fact that technological innovation is not the only factor to gain market share in the increasingly segmented L2 market.

Nevertheless, Scroll has shown signs of growth since its launch, with TVL growing to $55.7 million and an average of 7,856 users flowing in weekly.

○Taiko

Taiko aims to be a Type-1 zkEVM.

Type-1 zkEVM solutions provide unparalleled compatibility with Ethereum and a fluid developer experience, although they may have some performance compromises.

Multiple testnets will be launched throughout the year, with the mainnet scheduled to launch in 2024.

◼️Other Notable Trends

○Dencun Upgrade and EIP-4844

Ethereum's Dencun hard fork scheduled for Q1 2024 includes several upgrades that will bring significant changes to the L2 market.

In particular, EIP-4844 (Proto-Danksharding) enhances both the cost-effectiveness and scalability of rollups.

Compared to the current calldata space used by rollups to submit data to the Ethereum mainnet, it presents a more cost-effective solution that could potentially reduce costs by 80-90% and further activate the L2 market.

○Rollups-as-a-Service (RaaS)

Major L2 networks are introducing technologies that allow developers to launch their own rollups, providing dApps with customizable execution layers with rich blockspaces, albeit sacrificing some decentralization and security.

Solutions like Arbitrum's Orbit chain, Optimism's OP stack chain, zkSync's Hyberchain, and Polygon CDK are becoming the focus of next-generation rollup technology.

This movement is expected to revitalize the RaaS market and drive the growth of noteworthy players such as Conduit, AltLayer, Caldera, Gelato, and more.

○Decentralization and Security of Rollups

Rollups are essential to Ethereum's technical roadmap and must adhere to the Ethereum community's strict decentralization and security standards.

Rollups are still in their early stages, and most current rollups conveniently operate their own centralized sequencers, which are user-friendly and cost-effective.

However, with the maturity and growth of the rollup market in 2023, perspectives are beginning to shift towards the decentralization and improved reliability of sequencers.

Arbitrum is one of the projects that is already addressing this early on, but most rollup projects have sequencer decentralization on their roadmap.

At the same time, shared sequencer solutions like Espresso, Astria, and Radius are emerging.

○zk Technology

Not only zkEVM, but several important advancements shape the landscape of ZK-based technologies.

One notable advancement is the ZK processor, which allows dApps to offload data-intensive and costly computations off-chain.

This not only reduces gas costs for users but also enables the execution of more complex functionalities and computations, improving the overall user experience.

That concludes the first part.

Assuming the original report is excellent, I am pleased to have compiled an article that summarizes the market trends for 2023 very well. In today's first part, I covered the overall market, L1 market, and L2 market. In tomorrow's second part, I will discuss DeFi, stablecoins, NFTs, GameFi, and SocialFi markets. Please look forward to it!

Reference & Image source: "Full-Year 2023 & Themes for 2024"

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

A web3 newsletter delivered in five languages around the world. We deliver various articles about web3, including project explanations, news and trend analysis, and industry reports, every day. You can subscribe for $8 per month ($80 per year) and receive research articles that took 100 hours to complete every day.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.