【Aster】Next generation Peps DEX centered on BNB chain / Rapid growth with CZ's support and TGE / @Aster_DEX

Will it be a Hyperliquid killer?

Good morning.

I am mitsui, a web3 researcher.

Today I researched "Aster".

🏦What is Aster?

🚩 Transition and Prospects

💬Will it be a Hyperliquid killer?

🧵TL;DR

Aster is the next generation Peps DEX created from the merger of Astherus and APX Finance, featuring multi-chain expansion around the BNB chain, up to 1001x leverage and the ability to use equity Peps, spot trades and yield assets (asBNB, USDF) as collateral.

Starting with the ApolloX launch in 2021, Astherus' yield product, the integration at the end of 2024, the introduction of transaction mining and equity Peps in 2025, and the support of TGE and Rapid Growth and CZ in September have attracted attention.

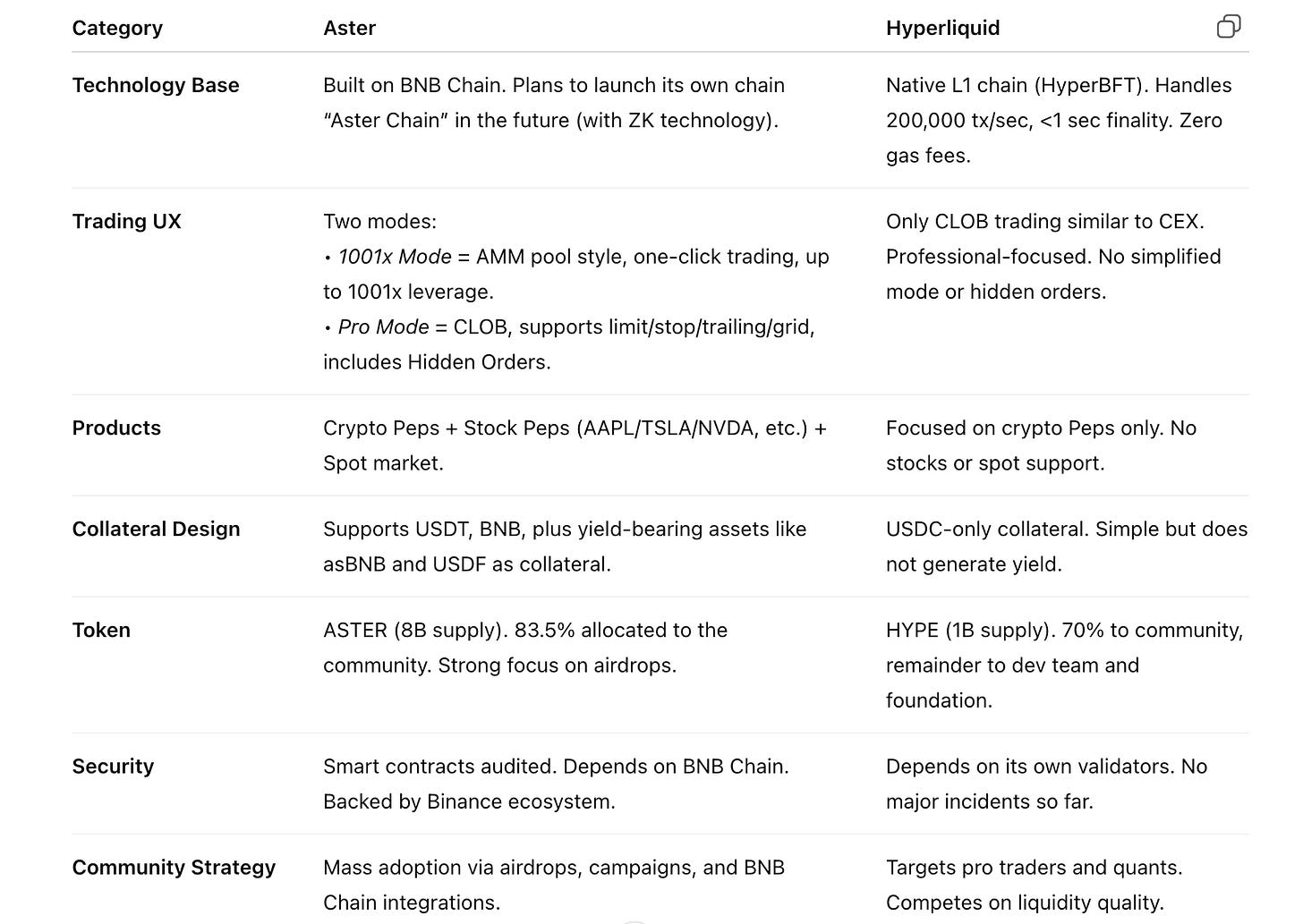

While Hyperliquid is a professional-specific proprietary L1 chain DEX, Aster is increasing its presence as a competitor originating from the BNB chain with mass-market UX, yield security, and future proprietary chain plans.

🏦What is Aster?

Aster" is a next-generation perpetual dex that is gaining attention as a competitor to Hyperliquid.

At the end of 2024, Astherus, a multi-asset management protocol, and APX Finance, a perpetual DEX, will be merged and rebranded to provide a "perpetual trading platform for everyone" by leveraging the strengths of both projects.

Aster has a multi-chain support policy, and its services are currently available on multiple chains, including the BNB chain, Ethereum, Arbitrum, and Solana. (However, most of the trading volume at this time is BNB, so it is effectively a perpetual DEX on the BNB chain.)

The main functions and features are as follows

◼️ Perpetual (indefinite futures) trading

Aster's core feature, offering permanent futures on crypto assets and equity indices with very high leverage of up to 1001x.

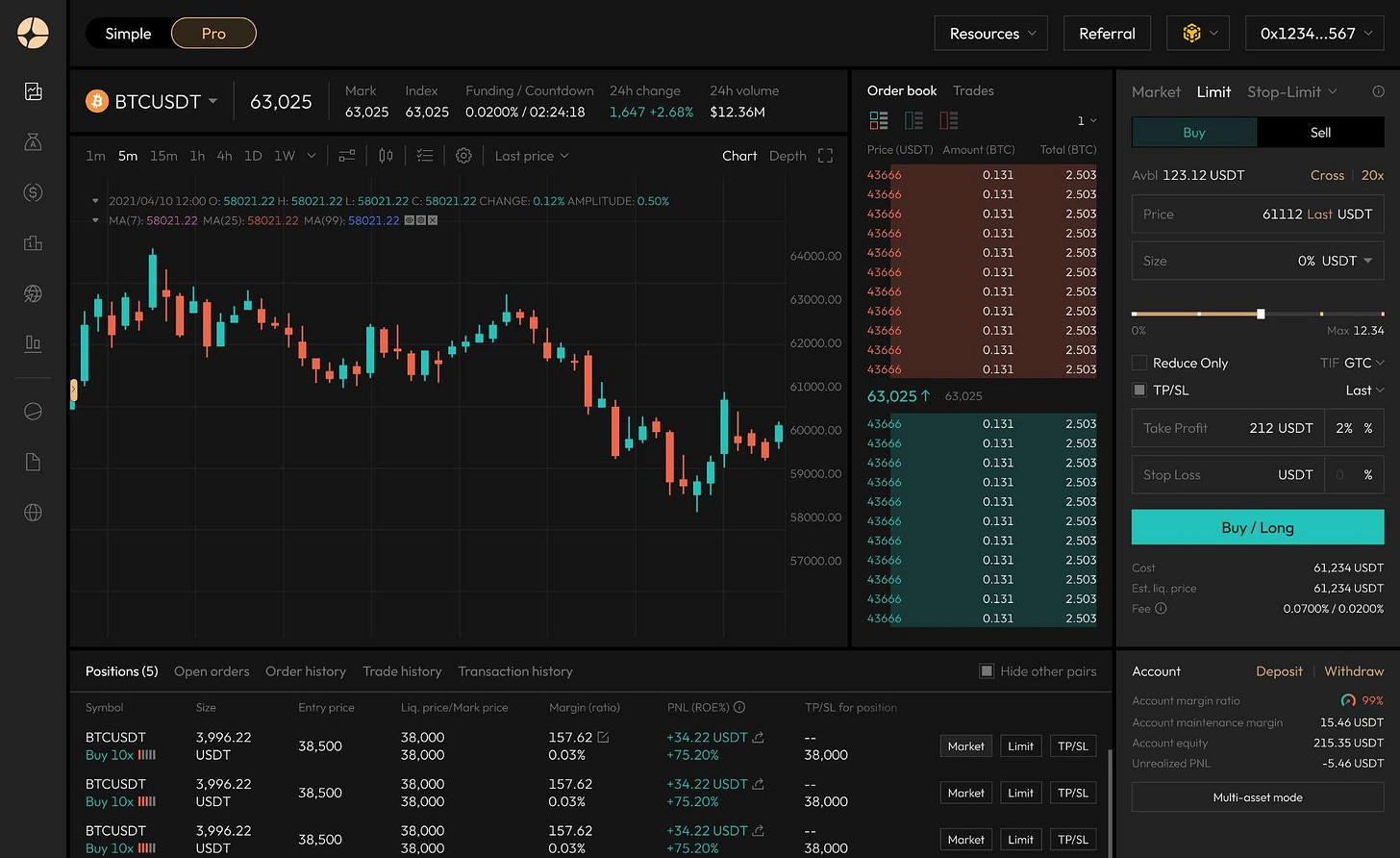

Two modes are available depending on the user's trading style.

Pro Mode:It features a CEX-like order book interface and offers advanced trading capabilities. Competitive commission rates of 0.01% for makers and 0.035% for takers are available, as well as specialized tools such as grid trading and hidden orders. The system aims to achieve efficiencies comparable to CEX in an on-chain environment.

Simple Mode (1001x Mode):Offers MEV-resistant on-chain perpetual futures trading that can be executed with a single click . Offering extremely high leverage of up to 1001x, it is designed to make it easy for DeFi beginners to participate in trading without being overwhelmed by the complex interface.

Currently, there are approximately 25 different markets listed, including BTC and ETH, with a trading volume of $532B to date.

In addition to perpetuals, physical (spot) trading is also supported for some tokens. For example, an AST/USDT spot market was also opened after the ASTER token TGE in September 2025.

◼️ Staking and liquidity provision (Earn function)

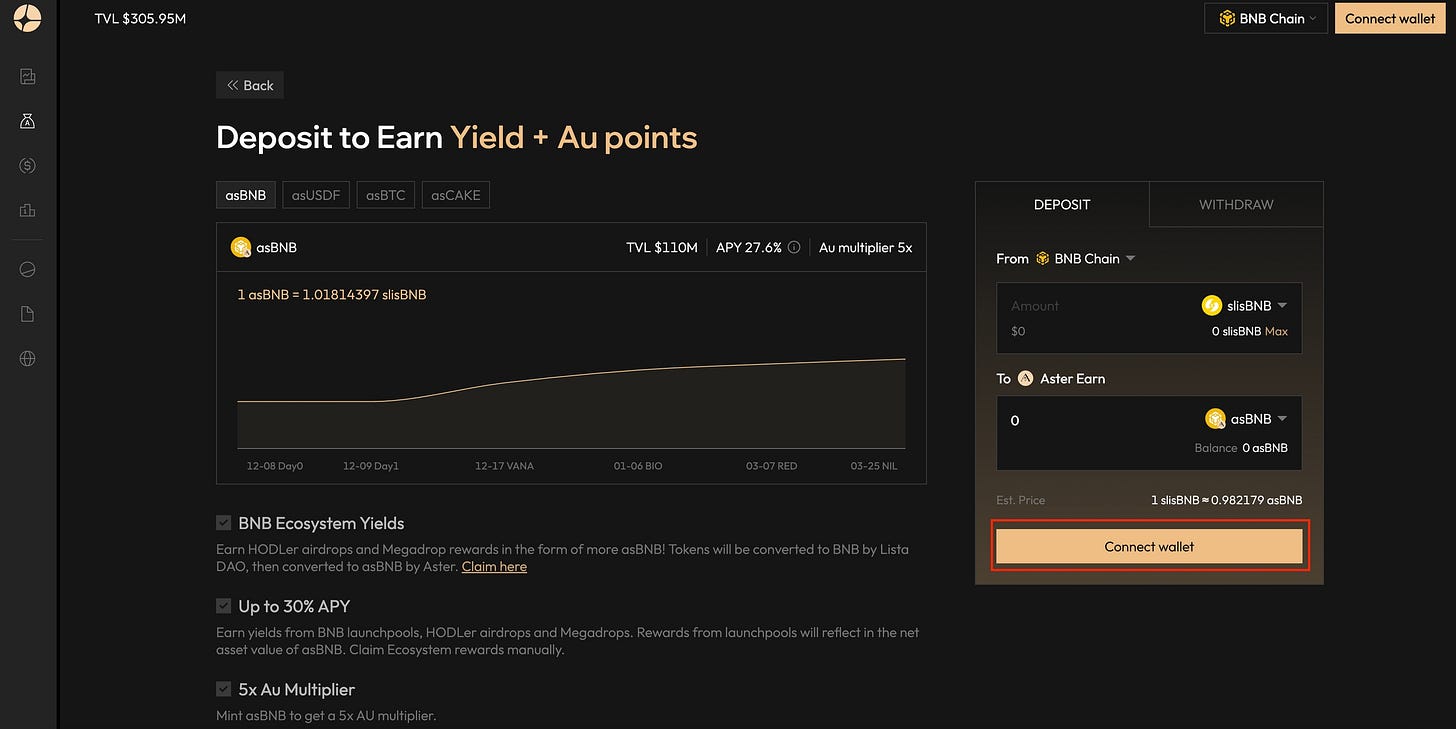

Aster is unique in that it is not just an exchange, but integrates its own yield generation product.

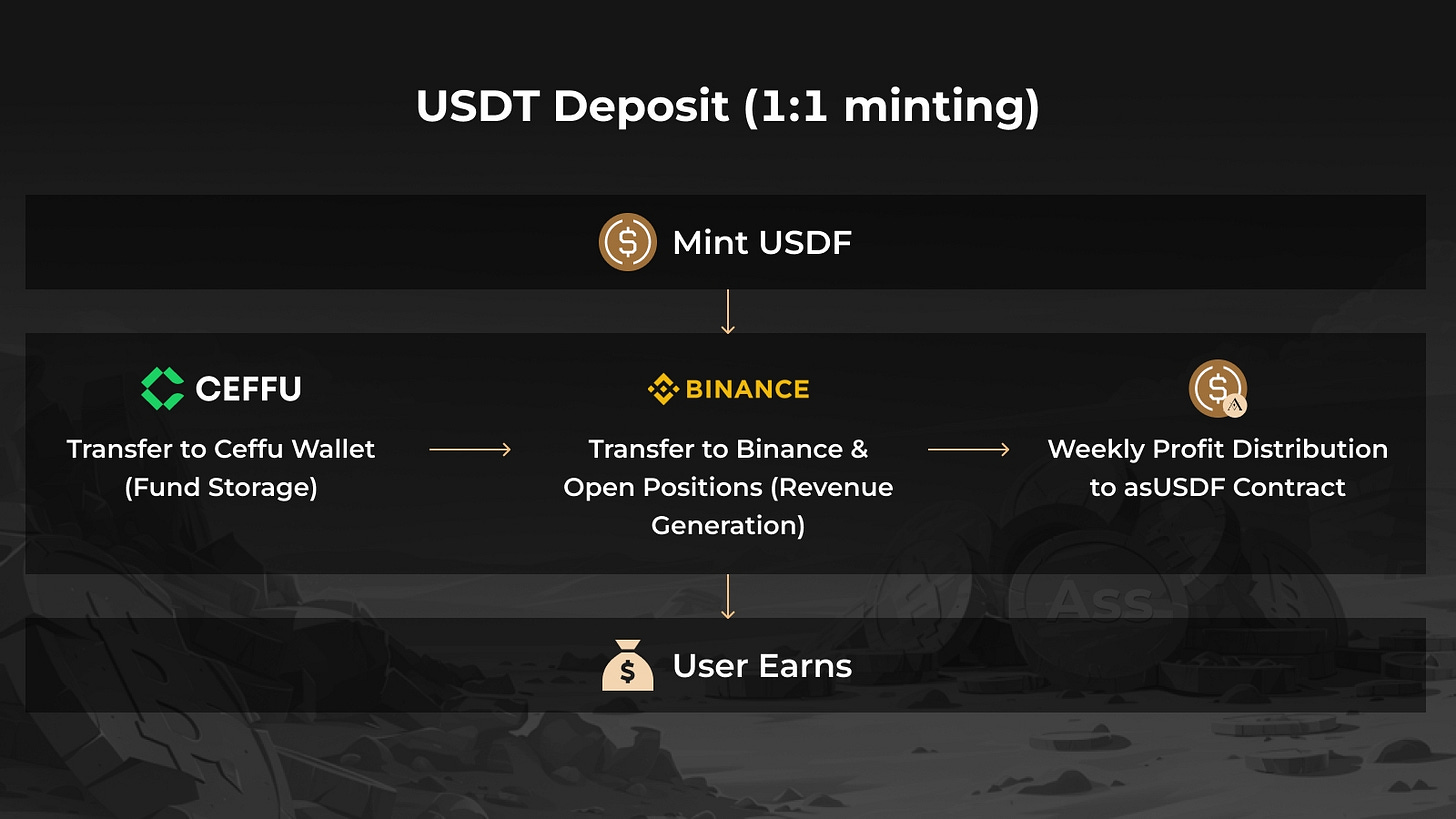

Typical examples are asBNB, an LST issued by depositing BNB, and USDF, a yield-granting stablecoin that is exchangeable 1:1 for USDT.

The asBNB is a token that provides additional incentives within Aster in addition to validator rewards from staked BNBs, and the USDF is a mechanism that generates interest by managing the underlying asset, USDT, in a delta-neutral strategy. Users can mint and hold these tokens for passive income and also enjoy benefits such as discounted transaction fees and preferential airdrop points on Aster.

Users can use these yield assets such asBNBs and USDFs as collateral for their trades. This mechanism improves capital efficiency by allowing users to earn passive income from collateral assets as well as profits from trading. This not only allows users to efficiently utilize idle assets, but also creates an incentive to retain liquidity on the platform for an extended period of time.

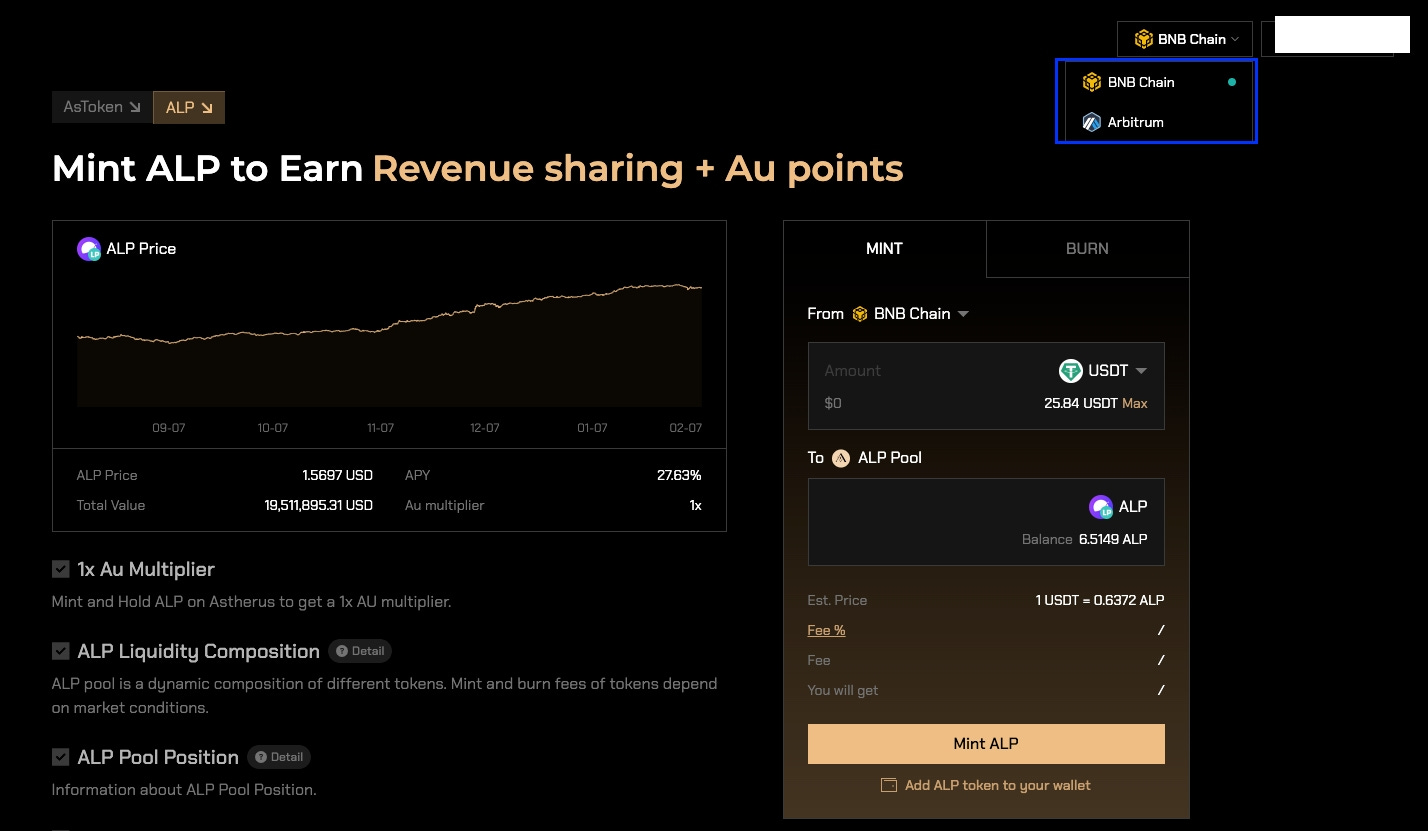

◼️Liquidity Pools and Market Makeup

The foundation of the 1001x mode, which is the DeFi novice of the two modes described earlier, is the Aster Liquidity Pool (ALP), a pooled liquidity mechanism provided by Aster.

Users can mint ALP tokens by depositing various assets (BTC, ETH, BNB, USDT, etc.) into the pool, which becomes a source of liquidity for the market. Assets offered to the pool act as counterparties for traders (acting like AMMs), and LPs (liquidity providers) benefit from spread and commission revenues.

🚩Transition and Outlook

Aster achieved TGE in September 2025 and has been growing rapidly around that time.

At the time of writing, it is second only to Hyperliquid in terms of trading volume for 24-hour perpetual futures.

We will briefly review the transition.

November 2021.ApolloX (APX) platform is launched, starting as a hybrid CEX/DEX futures exchange and later evolving into the largest perpetual DEX on the BNB chain.

April 2023.APX Exchange v2 released; UI and liquidity enhancements catapult APX to the top perpetual DEX in trading volume within the BNB chain.

2024.Astherus emerged as a multi-asset yield platform on the BNB chain, offering asBNB, which integrates yield sources such as Binance Launchpool and Megadrop, and USDF Stablecoin, which operates on a delta-neutral strategy and earns interest, to high acclaim. 11 In November, the company received an investment from Binance's investment arm, strengthening its ties to the Binance ecosystem.

End of 2024Formal announcement of the merger of Astherus and APX Finance. The two companies presented their plan to commit to the derivatives market of the BNB chain by launching a new project, Aster, through the integration of their technologies and resources. At this point, both projects were already leading the BNB chain and had the deep support of Binance/YZi Labs.

March 31, 2025.Aster rebranding/launch. After the completion of the merger, the new brand "Aster" was fully launched. With the merger, plans are underway to integrate APX tokens into ASTER tokens as described below.

April-June 2025.A transaction point program called Stage 1 Spectra was launched on April 10, offering users the opportunity to earn "Rh points" based on the volume of transactions they made on Aster, unlocking future token air drops. 20-week-long program concluded on June 22, with a total of 527,224 unique wallets participating during the period and a cumulative transaction volume exceeding $37.7 billion. This explosive growth in usage has catapulted Aster to the top of the protocol class, capturing nearly 20% of the Perpetual DEX market's monthly volume share in a matter of months.

July 2025.Aster launched equity index futures (Stock Perpetual). The company has entered the on-chain trading of non-crypto traditional assets with the launch of a futures pair backed by the U.S. stock Apple (AAPL). This allowed crypto traders to trade futures on large-cap stocks such as Apple, Tesla, and NVIDIA with up to 50x leverage on USDT collateral, signaling a strategy to attract a new user base.

August 2025.Aster has expanded its multi-chain deployment and enhanced its liquidity aggregator functionality to allow integrated trading of assets on Ethereum, Arbitrum, and Solana in addition to the BNB chain (seamless in the UI, but automatically handling bridging of each chain behind the scenes). This allows users to handle assets on various chains in a single interface without the need for manual bridging, facilitating cross-chain transactions.

In the same month, a Hidden Orders function was added to the professional interface. This is a dark pool order format in which the order book is not disclosed at the time of order placement, and the volume and price are kept secret until execution. This Hidden Order function implements the concept of "preventing front-running of large orders by dark-pooling the DEX," which CZ has been advocating for some time.

September 7, 2025.The official launch of physical trading (spot market) on Aster, in partnership with Four.meme, a leading incubator on the BNB chain, adds the ability to trade tokens from emerging projects directly on Aster's CEX-aligned UI. As a first step, the Four.meme-backed Creditlink (CDL) has been listed, bringing community funding from Four.meme's "BNB Guardians" program into Aster's trading ecosystem. This has allowed Aster to evolve into a comprehensive DEX that covers the cash market as well as perpetuals.

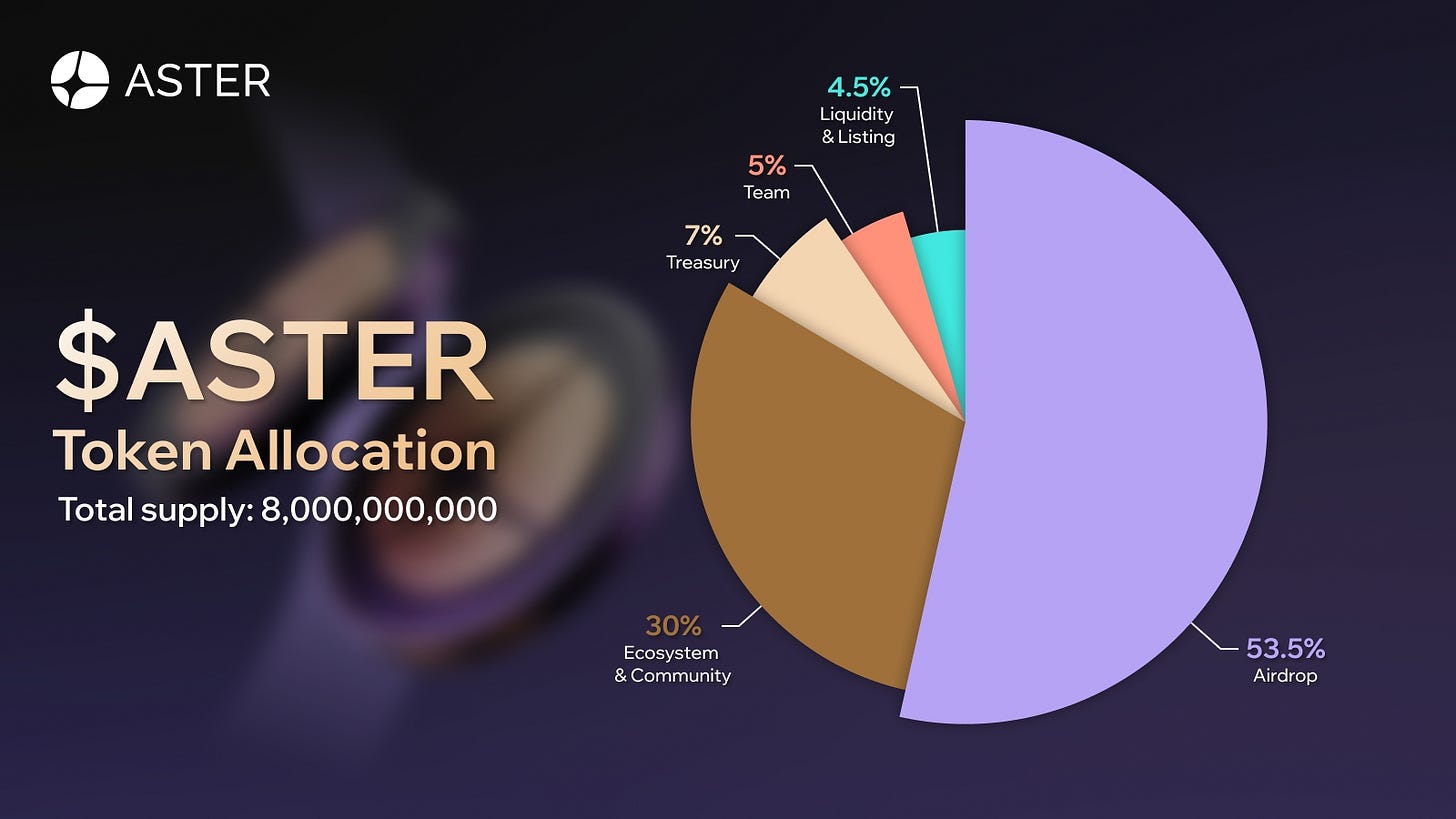

September 17, 2025 :.TGE. The long-awaited Governance Token $ASTER was generated and the airdrop distribution announced in Stage 1 took place. 8.8% of the TGE was airdropped and ASTs were only available for trading on the Aster platform on the day of the TGE. The platform TVL surged from $660 million to over $1 billion in one day, and daily trading volume reached nearly $1.5 billion.

September 20-21, 2025.The ASTER token price reached an all-time high of about $2.0 in four days (up about 9900%) from an initial price equivalent to $0.02. The ASTER price entered an adjustment phase from its highs and briefly sank to around $1.30, down about 33% from its peak of $1.96. Since then, however, it has remained in the $1.0-1.5 range and continues to show high volatility.

Aster is currently continuing its Genesis Stage 2 trade reward program, distributing tokens worth 4% of total supply as an incentive (scheduled for October 5, 2025), and trading participation for this incentive has been supporting prices. Stage 3 will begin immediately, and the distribution of rewards will be revamped with new rules that will extend score recognition to spot transactions as well.

Some of the excitement is due to purely product factors, but the biggest factor is still the anticipation that Binance founder CZ is supporting with quite a few mumblings.

There are also rumors of a larger commitment, as in a recent interview he stated that he would like to shift his focus from centralized exchanges to decentralized exchanges like Aster.

These expectations have led to a significant presence, attracting attention as the next generation of Perp DEX, primarily on the BNB chain.

◼️Hyperliquid vs

The No. 1 Perp DEX is Hyperliquid, and I will briefly summarize the differences between it and Aster.

My impression is that Aster is in a position to expand the perpetual futures that Hyperliquid started for professional traders to the masses. (Although, Hyperliquid has recently expanded to mass crypto users as well, with the Phantom integration, and the perpetual futures market itself is a rather trader-oriented market to begin with.)

Another major difference is the margin (collateral) design, which allows Aster to use yielded assets as collateral, whereas Hyperliquid cannot. However, Hyperliquid's recent decision to issue its own stable coin, $USDH, may actually have been born out of a sense of crisis against Aster.

Aster is planning to build its own chain called the Aster Chain, which will be designed to incorporate ZK technology and will combine privacy protection and scalability. Aster Chain will be designed to incorporate ZK technology, which will both protect privacy and provide scalability.

For example, the order contents and positions would be kept secret with cryptographic proof, while the matching performance would be as high as CEX. The roadmap calls for the test network to be operational from the end of 2025 to 2026, and the main network to be up and running by the end of 2026.

In addition, the use of ASTER as an on-chain voting system and governance token is expected to gain momentum in conjunction with the transition to a proprietary chain expected in 2026.

Specifically, it is envisioned that the allocation of transaction fees, changes to protocol parameters (clearing thresholds, fee rates, etc.), and decisions on the use of the ecosystem fund will be made by token holder vote. The introduction of the veToken model and liquid governance tokens is also being considered, with the possibility of developing the veNFT mechanism (lock-up and reward) that was introduced in the APX in the past.

This area is still unclear, but if the current number of users and TVL can be transferred directly to the proprietary chain, a large ecosystem could be created, second only to Hyperliquid.

💬Will it be a Hyperliquid killer

The final section is a summary and discussion.

Aster was definitely the trend in the crypto industry over the past few weeks, with the timeline filled with the surge and excitement immediately following the TGE. In my discussion here, I will try to predict the future rather than detailed trading strategies and features.

I think Aster's competitor is Hyperliquid, but when Hyperliquid came out it was touted as a Binance killer. the ability to perp with CEX-like liquidity and transaction speeds has led to a migration of users and transactions from Binance to Hyperliquid. Hyperliquid is now the most popular platform in the world.

The subsequent support of Aster by Binance and CZ seems to be connected.

Personally, what I find interesting is that Aster has also started to handle physical tokens as well as Perp, which will finally make them exactly like CEX. Also, BNB tokens themselves have been soaring recently due to Aster's success, but if they move to their own chain, it is possible that BNB's success will cease.

In light of these factors, I am also interested in the strategies and aims of Binance and BNB.

First of all, I think there is an aspect that we have no choice but to put ourselves on Perp in order not to lose as CEX has started to lose its advantage. In the future, it will probably be possible to connect to Aster from Binance itself or Binance Wallet, and I think that Aster Perp and physical listing will become a part of the Binance listing.

As mentioned in Coinbase's business strategy, I believe that CEX will be able to act as an interface and connect directly to DEX from within CEX. If we do not extend our own ecosystem to do so, profits will flow to other ecosystems.

So, we will continue to watch Aster's future moves as they may provide a good opportunity to predict the Binance ecosystem strategy.

This is the research for "Aster"!

🔗Reference Link:HP / DOC / X

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.