【Aria Protocol】A protocol to convert music and other IP revenue rights on Story into small tokens (IPRWA) that can be traded and held by anyone / @Aria_Protocol

First phase tokens songs by Justin Bieber, BTS, Black Pink, etc.

Good morning.

I am mitsui, a web3 researcher.

Today we researched the Aria Protocol.

🎧What is the Aria Protocol?

🚩 Transition and Prospects

💬The value of crypto is in democratization.

🧵TL;DR

Aria Protocol aims to eliminate the lack of liquidity and barriers to entry in the IP market by converting music and other IP revenue rights on Story into small tokens (IPRWA) that anyone can trade and hold.

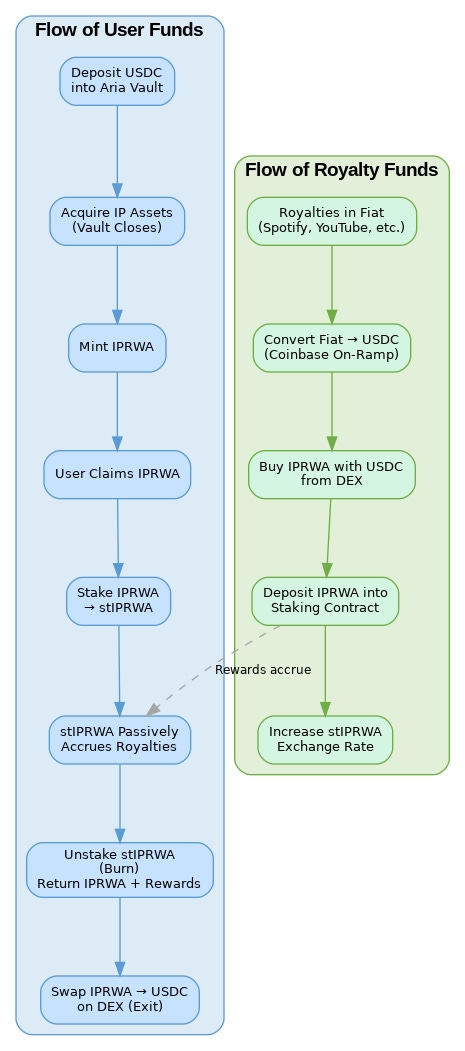

The $APL is the first music IP portfolio token and is structured as USDC procurement -> IP purchase -> $APL distribution -> $stAPL receipt by staking -> $APL build-up (effectively rebasing) with royalty-derived Buyback.

Rights are royalty-related only, no ownership rights are granted, not available in the U.S., U.K., etc., and subject to regulatory and tax restrictions and high risk (unsecured, uncertain liquidity), including 30% U.S. tax withholding and possible KYC requirements.

🎧What is the Aria Protocol?

The “Aria Protocol” enables the issuance of IPRWA (Intellectual Property Real-World Asset) tokens that are collateralized with revenue rights arising from real-world IP, such as music copyrights built on Story, to be traded and held on the blockchain. Protocol.

The first use case we are focusing on is tokenization of music IP.

Traditionally, investment in copyrights and royalty income from hit songs has been limited to a few wealthy individuals and music industry insiders, and ordinary fans and private investors have been unable to participate. Aria aims to address this lack of liquidity and barriers to entry in the IP market.

Aria allows music streaming and licensing revenue-generating rights to be converted into small tokens that can be purchased and held by fans, allowing them to enjoy a portion of the revenue generated by a hit song.

At this time, a token backed by music copyright (IP) called $APL has been released, and we will use this as an example to explain the details.

◼️$APL(Aria Premiere Launch)

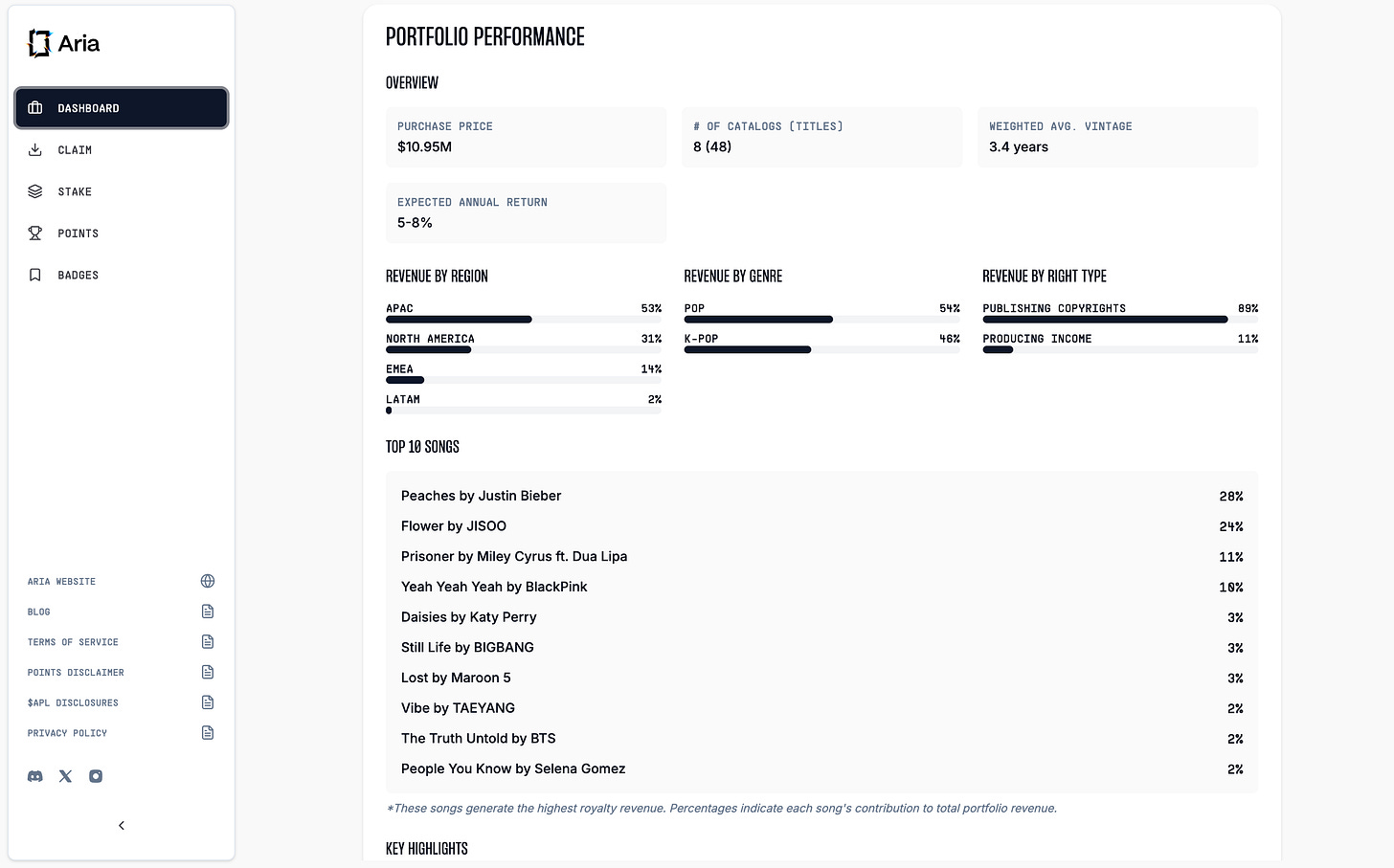

$APL was the first music IP rights portfolio launched by Aria, with approximately $10,947,000 worth of tokens issued.

The detailed flow of funds is shown below, but we will roughly summarize the flow of funds.

Aria Announces Fund

Interested users deposit USDC.

Once the target amount is reached, the actual IP is purchased with USDC deposited by the user.

IPRWA tokens backed by that IP are issued (distributed based on the amount deposited by the user)

Secure royalty income by staking those tokens.

Aria Premiere Launch ($APL) was conducted on StakeStone’s LiquidityPad platform, which is DeFi’s liquidity delivery platform that Aria leveraged to raise and lock in $10.95 million. lock and used the funds to purchase IP.

$APL is an IRPWA token that has purchased 47 prominent music tracks.

The list is public and includes songs by world-class artists such as Justin Bieber, BTS, Black Pink, and others.

The $APL holder receives $stAPL by staking its own $APL and receives a distribution of IP royalty revenue. Strictly speaking, the distribution method is not a direct hand-off, but rather a buy-back of $APL from the market using royalty revenue and channeling it into a staking contract (vault) for $stAPL holders. This increases the total amount of $APL that can be earned when $stAPL is unlocked, so from the user’s perspective, the value of $stAPL is rebased. (As we will see later, this is probably done with regulation in mind.)

Currently, the APY is around 6.5%~10.41%.

Aria is a protocol whereby users deposit funds and thereby issue IPRWA tokens that Aria purchases IP off-chain, backs, and distributes royalty income.

Although off-chain processing is inevitably interspersed, a mechanism is in place to map off-chain legal contracts and certificates to tokens on the blockchain when IP rights are tokenized, thus maintaining transparency.

In addition, although royalty income is currently only distributed, in the future, as a “programmable IP,” the smart contract will manage the licensing terms for remixes and derivative works and automatically distribute the revenue to the original rights holders and token holders.

By using automatic licensing through smart contracts, fans and other creators can easily create remixed versions and spin-offs of popular songs with the permission of the rights holders, and the revenue generated from these works is shared fairly among the original rights holders, token holders, and secondary creators. The revenue generated from this will be shared fairly among the original rights holders, token holders, and secondary creators.

🚩Transition and Outlook

Aria Protocol is developed and operated by a corporation called Aria Protocol Labs Inc. The company is headquartered in Wilmington, Delaware, USA, and is legally incorporated in the United States.

In addition, the Aria Foundation, a non-profit organization responsible for the long-term development of the ecosystem and based in the Cayman Islands, has been established to oversee developer grants, community-driven initiatives, liquidity programs, and partnerships, It is expected to be at the core of future decentralized governance.

The project is said to have been founded by “music industry veterans,” but no details about specific members have been disclosed. The project founder (CEO equivalent) uses the handle RWAkefeller.ip in the community, and is noted as an anonymous founder whose real name is unknown, but is a play on “Rockefeller of RWA.

Meanwhile, the co-founder and Chief IP Officer is David Kostiner. Mr. Kostiner is also the managing partner of Counsel LLP, an entertainment and intellectual property law firm based in San Francisco, and has extensive knowledge and contacts in the music copyright business.

◼️ funding

In September 2025, the company raised a total of $15 million in a seed + strategy round that included Polychain Capital, Neoclassic, and the Story Protocol Foundation.

It is also reported that the company has secured a total of $50.7 million in support from prominent Korean investors such as SV Investment, KB Investment, and Hana Financial Group, which are believed to be funds with an eye toward acquiring IP in the K-POP field.

In fact, the company has partnered with Content Technologies, a South Korean content investment company, to tokenize its large K-pop music catalog (which is more than half the size of South Korea’s global music distribution market), “Aria PRIMEThe project has been initiated.

◼️ own token

The issuance of $ARIA is planned as the Aria Protocol’s own native token; details are not yet available as of September 2025, but it is expected to become the protocol’s governor and utility token in the future.

At this time, the company has introduced its own loyalty program called “Aria Points,” where users can earn points based on their use of and contribution to the platform. These Aria Points are said to be redeemable for $ARIA tokens in the future, effectively functioning as a loyalty program prior to the token launch.

For example, the Aria Premiere Launch in February 2025 awarded participating users with Aria Points along with rewards from StakeStone and Story Protocol.

◼️ now and then

There is no publicly available roadmap, but the company first states that it is “planning several additional IP launches” during 2025 to expand its IP assets and will be expanding into non-music areas (art, film/TV).

In the music area, Aria PRIME, which will tokenize the large K-Pop catalog described earlier, has just been launched, and there is potential to expand this to other regions and genres (e.g., U.S. hits of yesteryear, movie soundtracks, etc.).

In terms of technology, the realization of “Programmable IP” is the keyword. Specifically, following the current infrastructure (IP rights on-chain and revenue sharing mechanism), the plan is to build an IP licensing and remix licensing platform based on smart contracts after 2025. Once this is realized, a new participatory ecosystem will become possible, for example, by holding a music remix production competition exclusively for token holders on Aria, and automatically distributing revenue to the original rights holders and remixers.

💬The value of crypto lies in democratization

The last part is a consideration of the summary.

The mechanism itself is very straightforward, but I think it’s a pretty revolutionary protocol, I think it represents Story’s tokenization of IP, and most importantly, it’s amazing that they are able to procure world-class assets.

Moreover, you can participate without KYC. However, as we are dealing with global assets, they are very careful about regulations, and it says that users from the following countries are not allowed to access.

Belarus

Cuba

Iran

North Korea

Russia

Syria

Ukraine

United Kingdom

United States

Also, properlyDisclosure Information to $APLis listed.

A very rough summary is as follows.

The $APL is a token tied to the revenue of the music IP catalog and can be claimed at depending on the amount of Vault holdings. Total supply is fixed at 10,947,535.

No ownership rights are granted, only royalty-related rights. Designed to receive LST ($stAPL) on staking and can claim increasing $APL on Buyback.

Non-registered under the U.S. Securities Act, etc. (Reg S premise) and not available in multiple countries including the U.S. and U.K. Automatic deduction of 30% from U.S. sources for tax purposes, with KYC submission requirements depending on circumstances. High-risk, unsecured and subordinated.

So, this is going to be a bit long, but I think you’ll learn quite a bit here, so I’ll focus on the main points and add a few more.

1) Claim

Eligibility: Vault Token holders in the StakeStone Vault.

Supply: $APL total supply fixed at 10,947,535 (allocation based on Vault holdings as of 2025-05-16 12:00 ET).

Duration: 2025-06-25 18:00 ET to 2025-12-25 18:00 ET (can be changed or terminated at company discretion).

Payment: No additional fee is required (gas only).

IMPORTANT: The company may change this Claim and the terms (including Staking/Buyback) at any time.

2) Details of rights

No ownership rights to the catalog are granted.

APL Catalog (including partial rights to 48 songs) is owned exclusively by the company.

The holder is only given certain rights regarding royalties.

Revenue sources: streaming, licensing, public performance, etc. expected (no guaranteed accrual).

3) Staking

Contract: 0x73d600Db8E7bea28a99AED83c2B62a7Ea35ac477.

How it works: $stake $APL and receive $stAPL (LST) at 1:1 (at start).

As the $APL additionally staked in Buyback increases, the Exchange Rate (Exchange Rate) changes.

At the time of unstaking, receive the accumulated $APL based on the ratio at that time.

May be required to submit KYC or other identification documents at the time of unstaking (company discretion).

4) Buyback Program

The company buys back $APL from the market with the royalties received (after tax and expenses) and puts the Purchased Tokens into a staking contract, which the LST holder can then claim.

No guarantee of success or liquidity / Can be discontinued at any time. Possible introduction of management fees in the future.

5) Liquidity and transactions

Company plans to create a liquidity pool for $APL and LST to provide and trade liquidity on an ongoing basis (with its own MM). → A dedicated company has also been established in BIV.

6) Tax, KYC, etc.

30% automatic tax withholding to the U.S. IRS in connection with Buyback.

Holders handle their own tax returns and refund claims on their own.

Technical risks are your responsibility (”as is”). Sending to non-compliant wallets, etc. is also at your own risk.

The company can require KYC submissions (especially during unstake, as required by regulatory, tax, and compliant requirements).

7) Priorities and risks

The company’s obligations under the $APL are general unsecured obligations and are senior to secured debt, priority claims, etc.

Possibility of loss of principal and total loss in the event of bankruptcy.

High volatility/ illiquidity, possibility of no/thin public market.

Rules and programs can be changed at the company’s discretion.

8) Restricted countries (not for residents)

Belarus, Cuba, Iran, North Korea, Russia, Syria, Ukraine, the United Kingdom, and the United States.

Not for sale to U.S. Persons (”U.S. Person” in Reg S).

Utilizes exemptions (Reg S, etc.) from foreign securities regulations without being registered.

For more information.backlink (to a site, as used in page ranking that site)for more information.

However, it seems to me that the company is providing this service by successfully circumventing the regulations. Of course, there are many aspects of the disclosure information that can be changed at the company’s discretion, and some of the mechanisms are trustful, but given the current laws, I think this is not an option in many areas.

And it would be quite interesting to see this kind of system start in Japan. Japan is an IP-rich country, so assets such as music, animation, manga, etc. are unlimited. If these assets can be accessed without KYC as an investment entity, it will open up opportunities for the general public to access new revenues.

Personally, I believe that one of the great values of crypto is democratization, and DeFi is particularly straightforward: it guarantees access to finance in the first place and allows anyone, anywhere to access any opportunity that was previously closed to them. RWA tokenization is an extension of that, democratizing investment opportunities that were previously black boxes.

IP investment is one such example. For example, it has been impossible for individuals to join a production committee for a movie, but with this protocol, it may be possible for individuals to participate in it.

And I also see a great deal of potential for this to be a thrust that will be more than just an investment. I look forward to the next tokenization.

This is the research for the “Aria Protocol”!

🔗 Reference:HP / DOC / X

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.