【Anzen】Issues USDz, a stable coin backed by RWAs / Offering 80% yield despite being a stable coin / Using Base / Loyalty program underway / @AnzenFinance

It is backed primarily by U.S. private credit assets.

Good morning.

This is mitsui from web3researcher.

Today I researched "Anzen".

🔵What is Anzen?

💴USDz, yields over 80% with a threat!

💧Points Program Launched

💬High Yielding Stablecoins!

🔵What is Anzen?

'Anzen' is a DeFi protocol that provides permissionless RWA rewards backed by private credit at the institutional level. Currently, " USDz " is astabled coin backed by RWAs. Therefore, this article will discuss "USDz".

USDz" is a stable coin backed by RWAs and issued on Base. The underlying RWAsareprimarily U.S. private credit assets.

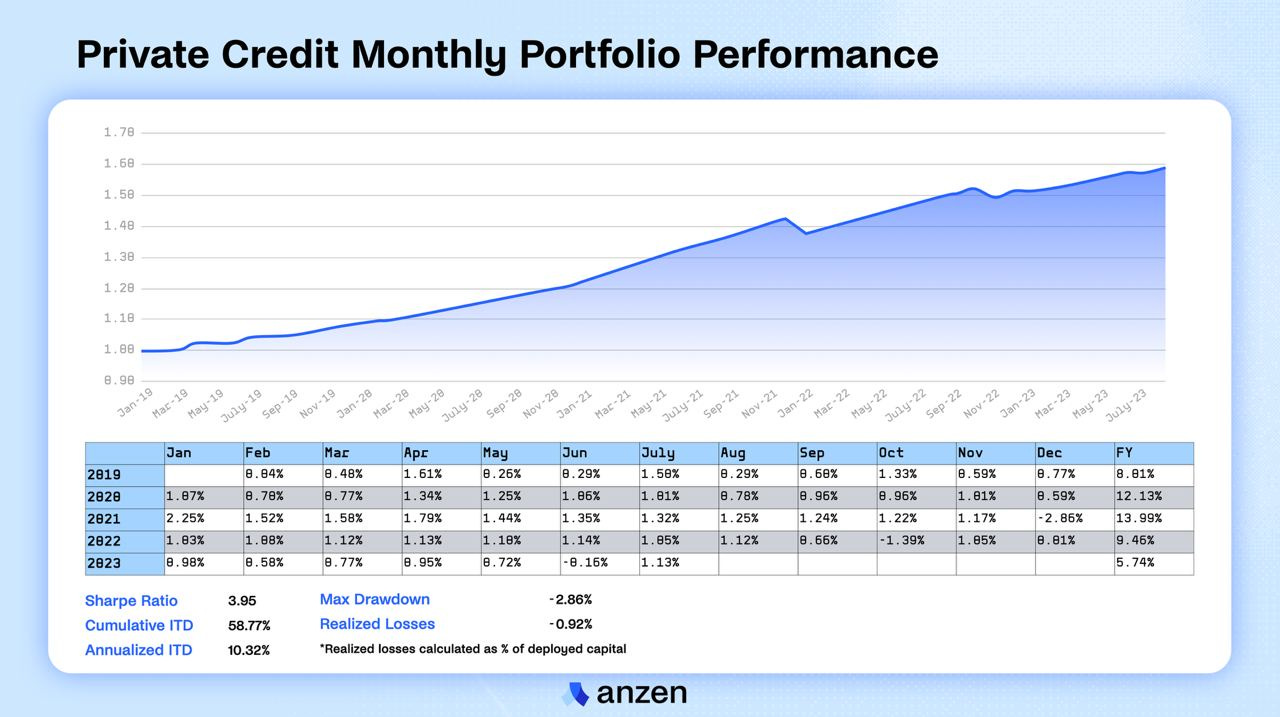

For underwriting and custody, Anzen has selected Percent, a licensed and established partner led by a management team with industry experience at institutions such as Blackrock, UBS, Goldman Sachs, and JP Morgan. Over the past seven years, Percent has processed 1.6 billion transactions with an Annual Percentage Yield (APY) of 16% and a default rate of 2%.

Incidentally, private credit is generally defined as the following two types of credit

Bonds that are not listed on any exchange or freely tradable on the open market

Credit products offered by lenders, whether banking or non-banking

It is an $8 trillion market in the U.S. and is ultimately composed of numerous submarkets that serve the vast borrowing needs of consumers and small businesses. Whereas the $40+ trillion U.S. public credit market, which serves the needs of governments, financial institutions, and large corporations, is highly standardized, the U.S. private credit market has historically been unorganized and highly fragmented.

In this context, lending is basically carried out under the following structure. The "Originator" is the company that extends credit to borrower clients based on underwriting criteria, the "SPV Borrower" is the underwriting company, and the "Investor" is the investor in the private securitization. Simply put, the scheme is that the "SPV Borrower" lends the money deposited by the "Investor" to the clients screened by the "Originator" and distributes the proceeds.