【3Jane】Unsecured USDC Lending Protocol running on Base / Calculates credit score using zkTLS for on-chain and off-chain information / Legally binding in case of default / @3janexyz

Has the potential to revolutionize the common sense of overcollateralized type.

Good morning.

This is mitsui from web3 researcher.

Today I researched about "3Jane".

🟦What is 3Jane?

⚙️Detailed Structure

🚩Transition and Prospects

💬Possibility of legally binding DeFi

🧵TL;DR

3Jane is an unsecured USDC lending protocol running on Base that scores borrowers' on-chain/off-chain credit data in real-time and grants them an immediate line of credit without collateral.

Lenders deposit USDC and receive ERC-4626 compliant USD3/sUSD3 tokens and earn base interest via Aave and borrower interest as yield distributed to preferred and subordinated tranches.

Credit decisions are executed by the 3CA algorithm, with zkTLS+Reclaim to capture off-chain data with privacy protection, and EigenLayer nodes to distribute and verify ZK proof to ensure transparency and trustworthiness.

In the event of default, losses are absorbed in the order of sUSD3→USD3 through immediate credit score reduction, overdue interest reallocation, on-chain receivables auction, and off-chain legal recovery to achieve sustainability of unsecured loans.

🟦What is 3Jane?

3Jane is an unsecured lending protocol deployed on Base.While traditional DeFi lending requires an excess pledge of collateral, 3Jane is a "credit-based money market" that provides USDC margin lending with 0% collateral (unsecured).

It is a P2P lending market based on smart contracts, where an algorithm calculates a credit line in real time based on the creditworthiness of the prospective borrower, and lends USDC immediately.This allows users to receive credit-based loans without time-consuming document screening.

Before going into the details of how it works, let me first explain the background behind the creation of 3Jane and the worldview it aims to achieve.

Since Aave's launch in 2017, DeFi has adopted an over-collateralized lending model, where users are required to provide collateral in excess of the loan amount.The over-collateralized lending protocol has achieved PMFs and grown TVL to $50 billion, with loan balances in excess of $10 billion.

While overcollateralization reduces the cost of capital, increases loan size, and, importantly, reduces risk for the lender, there are two major problems

Capital inefficiency: overcollateralization locks in more capital than liquidity provided.This leads to fragmentation of liquidity across protocols and chains, and incurs significant opportunity costs.This model was born out of the need to ensure the solvency of lenders in an anonymous and hostile context, where robust proof of identity does not exist.

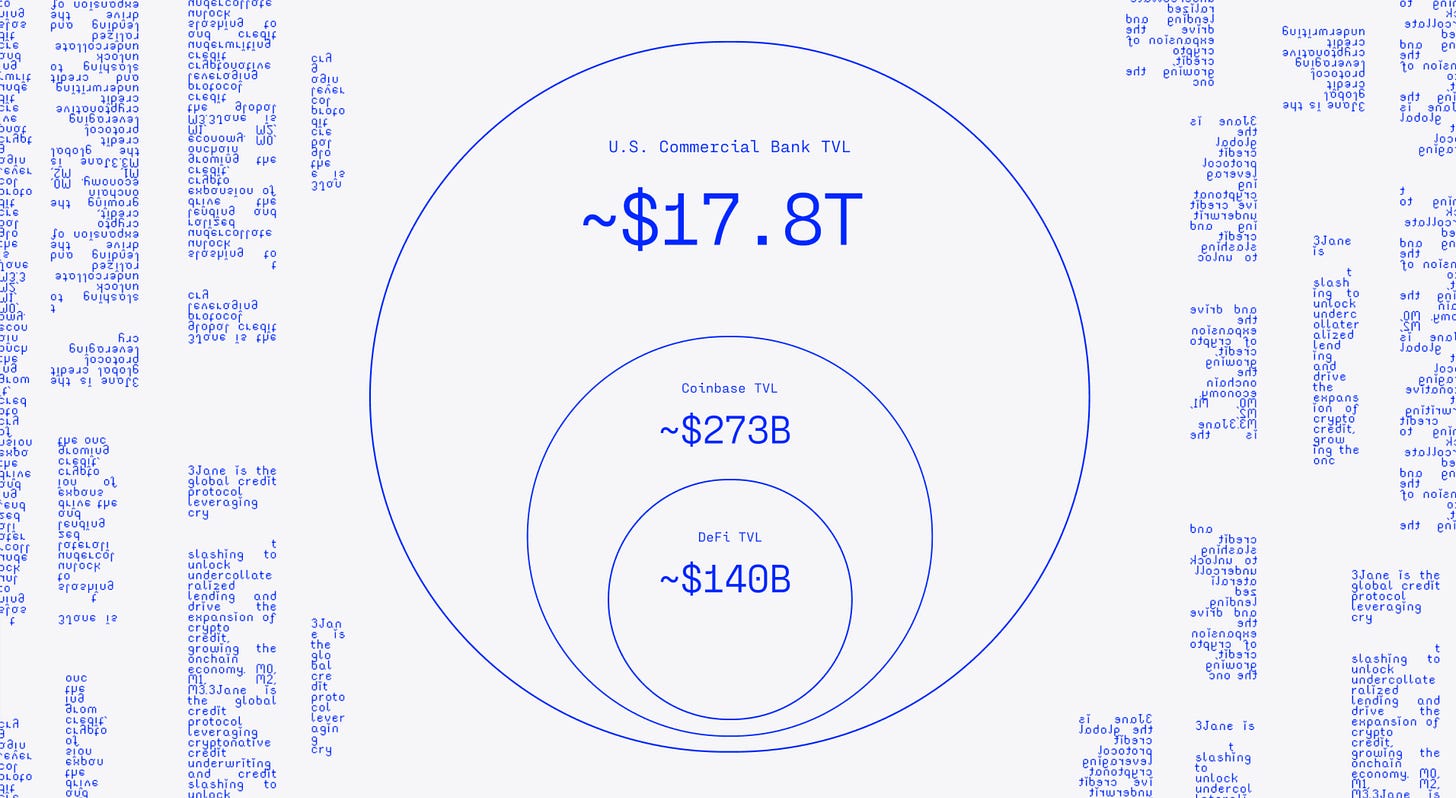

Minimum collateral base (limited market size): users can only borrow against assets that are listed on the blockchain, i.e., ERC-20, NFT, and ENS names.This limits the collateral base to DeFi's total TTL of $140 billion.Lending Protocol collectively ignores FICO Score, Coinbase's more than $273 billion in assets, more than $18 trillion in U.S. commercial bank deposits, and more than $23 trillion in annual U.S. personal income, which collectively are more than 100 times larger than DeFi's current size.

In response to these issues, "3Jane" was created to bring more than $1 trillion in provable soft collateral based on robust identity and verifiable proof into the system and to enable an era of unlimited credit growth in crypto assets.

Instead of collateral, the following three pieces of information are used to determine the creditworthiness of the borrower

Crypto and cash assets: ERC-20 and NFT, DEX deposits, Coinbase crypto assets, and bank cash via Plaid.

Cash flow: money market and staking yields, bank income via Plaid.

Credit Scores : We handle credit scores via the Cred protocol and FICO scores via Credit Karma.

In other words, it uses a unique credit scoring that combines on-chain and off-chain data to evaluate a borrower's ability to repay.

On the on-chain side, we integrate wallet history analysis models provided by Cred Protocol and the Blockchain Bureau to calculate a credit score for each crypto asset address based on a vast amount of transaction data, including past borrowing and liquidation history, asset holdings, and activity on DeFi.

Off-chain, on the other hand, leverages zkTLS technology to obtain assets, income, and credit scores from bank accounts and credit bureaus while protecting privacy.For example, it links a user's bank account or CEX account via its partner Plaid to verify credit scores such as Credit Karma with zero-knowledge proof.

By integrating these both on- and off-chain "verifiable financial proofs," we are able to merge traditional financial and web3 credit information to achieve advanced risk analysis.

The credit evaluation model is also designed with default issues in mind, and the unique recovery mechanism described below suppresses the incentive for strategic defaults in unsecured lending.

⚙️ Detailed Mechanism

Now, let's look at the more detailed structure and architecture of the protocol.

Below is the overall picture, with three main components

Core money marketConnecting borrowers and lenders.Detects USDC deposits from lenders, mints USD3 (and burns as well), and provides USDC loans to borrowers according to their credit lines.

Credit underwriterCredit underwriter: Responsible for "credit decisions for borrowers".Integrates on-chain/off-chain asset and credit data to calculate borrowing limits, interest rates, and repayment pace, and registers the terms and conditions in the CreditLine contract and guarantees its validity with ZK certification Distributed verification by EigenLayer verification node and zkTLS to guarantee the validity of the credit processEigenLayer verifies the credit process using distributed verification and zkTLS to ensure both transparency and privacy protection.

Credit slasherCredit slasher: a module that immediately lowers a borrower's credit score upon detection of late repayment or default, redistributes overdue penalty interest to healthy borrowers, and sells non-performing loans through on-chain auctions to collection agencies.This enables unsecured lending while limiting default risk.

I think you may have seen a few words, so I will explain them again, one at a time.

◼️Lender's Flow

First, let me explain the lender's perspective.

Lenders can deposit USDC into the protocol and mint an interest-bearing token called USD3, an ERC-4626-standard yield token backed by multiple CreditLines that are generated from deposited USDC.

USD3 holders receive a senior tranche of interest generated by the underlying loans.In addition, investors with a higher risk tolerance can also receive sUSD3 by staking USD3.

The sUSD3 is an ERC-4626 token, which is the junior tranche (subordinated debt), and enjoys a high leveraged yield from the interest on the entire pool, while being the first to suffer losses in the event of a borrower default.

This dual-tranche structure allows us to provide yields according to risk appetite while enhancing the safety of the senior tranche.

USDCs deposited by lenders are first deposited in the Aave v3 USDC market within the protocol and converted to aUSDC (Aave Interest Bearing USDC).This aUSDC is stored in the core funds market vault, and when a borrower requests a withdrawal, it is withdrawn from Aave and loaned to the borrower.

This design allows Aave to automatically accrue interest on idle capital (unloaned funds) in the pool, ensuring a baseline investment yield at all times.

Lenders hold USD3 or sUSD3 tokens, which represent their share of the overall pool, and continue to receive interest income as it accrues; USD3 can be redeemed (withdrawn) 1:1 with USDC at any time market liquidity permits, and sUSD3 can be redeemed for USDC after a specifiedsUSD3 can be converted to USD3 and then withdrawn to USDC after a specified cooldown period.

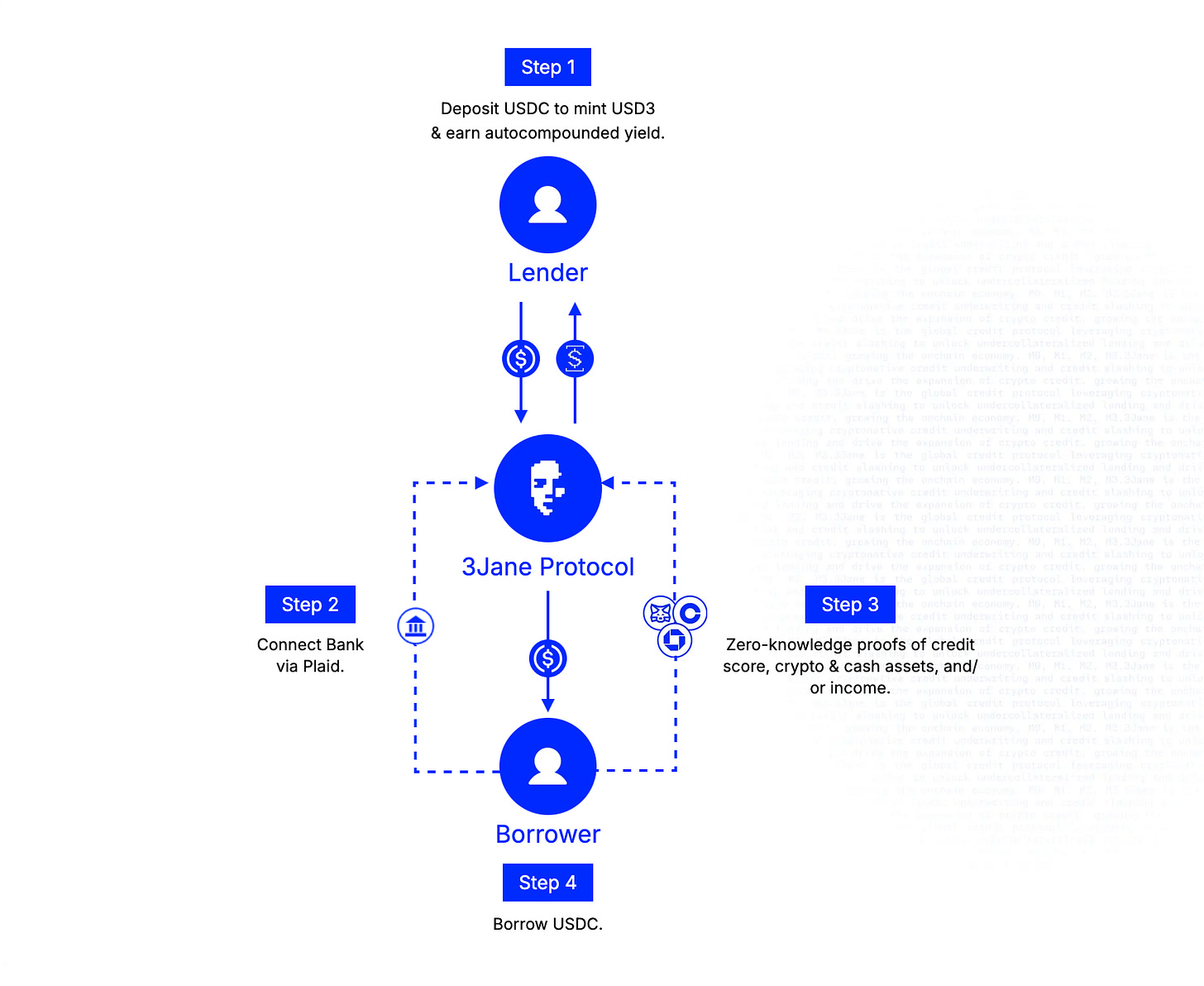

◼️Borrower Side Flow

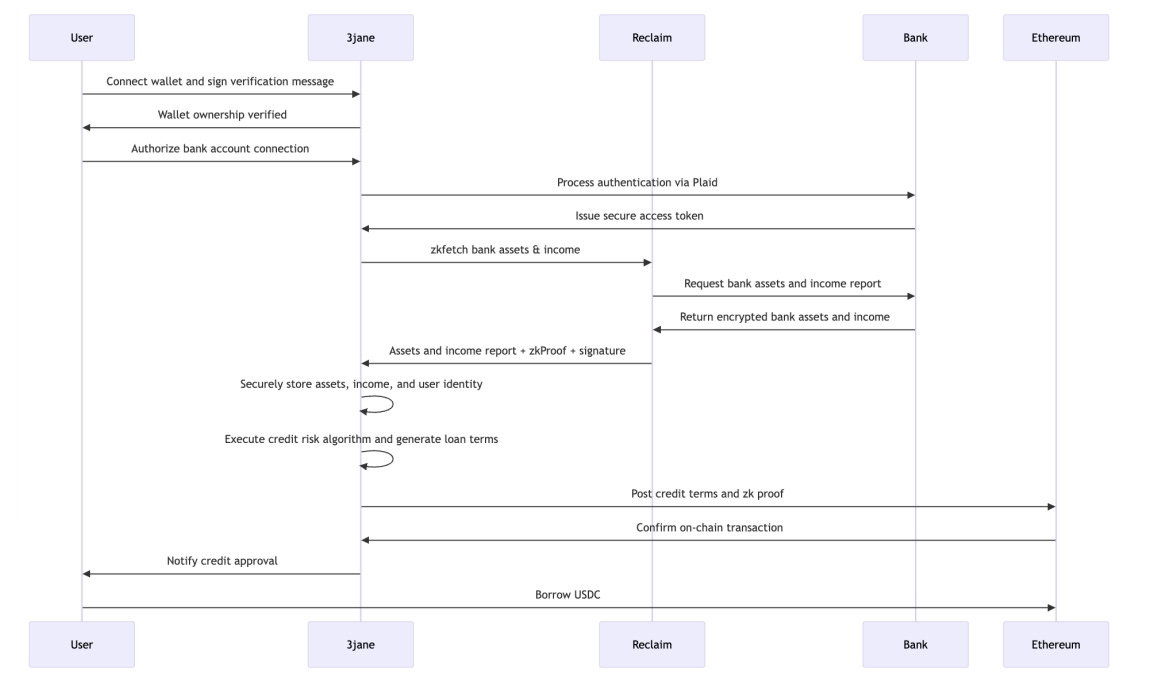

Borrowers can obtain a USDC-denominated line of credit (CreditLine) from the protocol by connecting their own Ethereum address (wallet) and linking their off-chain financial account.

Connect a wallet on the dApp and verify its ownership with a signature

Link bank accounts via Plaid and grant the protocol read access to one's banking assets and income data

(Optional) Connect other on-chain addresses, CEX accounts, credit score services, etc. (e.g., associate multiple ETH addresses with a signature, connect Coinbase accounts, provide FICO scores via Credit Karma, etc.)

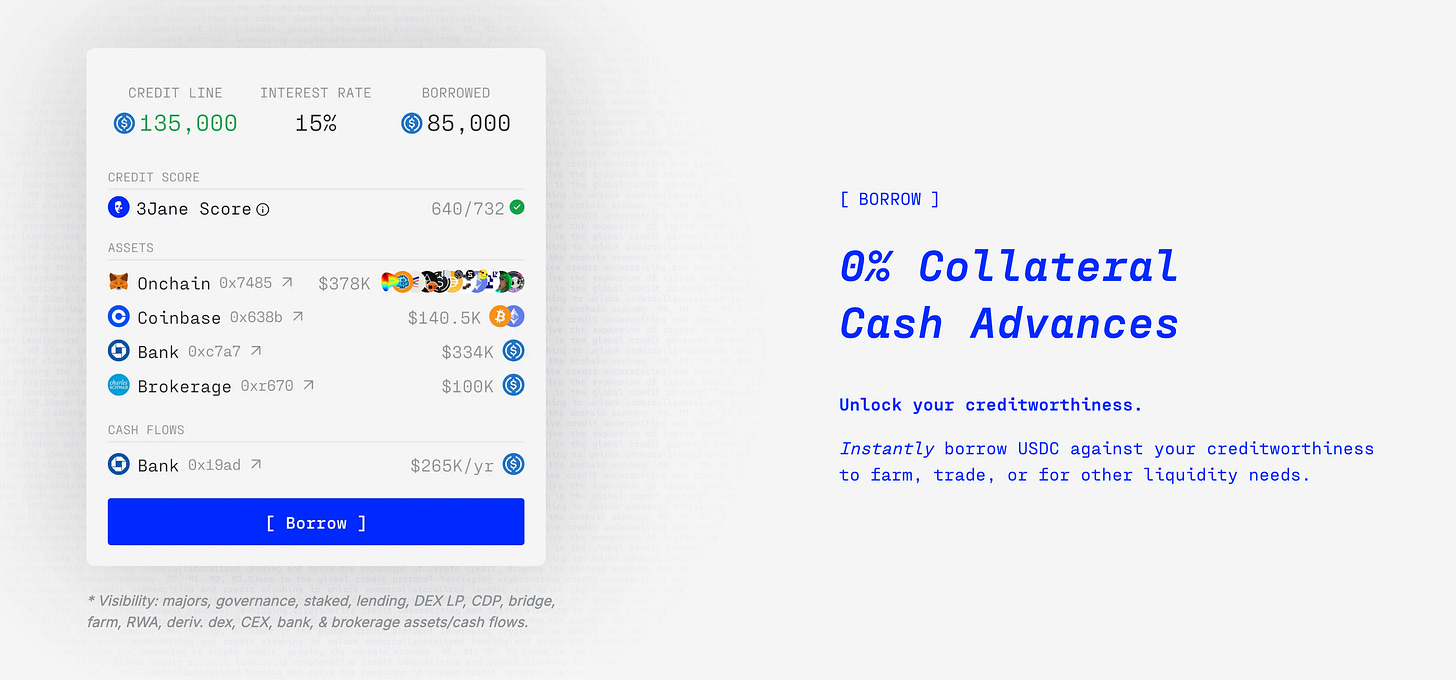

3Jane analyzes these on-chain and off-chain financial data in real-time using a dedicated credit evaluation algorithm and immediately calculates the following conditions for each user

Credit Line:.The maximum amount of USDC that a user can borrow without collateral

Credit risk premium interest rate: Additional interest rate based on the default risk of each borrower

Monthly repayment rate (RR)RR: Percentage indicating the pace of progress in principal repayment, set according to the estimated growth rate of the borrower's income and assets.

Record per-user credit lines and terms on the CreditLine smart contract and simultaneously write zk proofs on the zkTLSProofs contract (this presents the various scores and financial data on which the credit is based in a cryptographically verifiable form on-chain)

Electronically signing the terms of the MCA (Future Credit Agreement, Merchant Cash Advance), legally authorizing the repayment obligations associated with the unsecured borrowing

The borrower's ETH address is immediately assigned a USDC line of credit

USDC can be borrowed at any time within that credit line

There are a few key points, the first of which is to determine the borrower's credit line (Credit Line).

◼️ 3CA algorithm for credit determination

As mentioned above, credit decisions are made using on-chain and off-chain history, and these figures are calculated using a proprietary credit evaluation algorithm called3CA (Credit Computation & Capital Allocation) algorithmThis is determined by a mechanism called "3CA".

The 3CA integrates user data from multiple sources.Key inputs include

On-chain asset data: the total value of all DeFi assets held by the user.Specifically, this includes major ERC-20 token balances on EVM chains, NFTs, liquidity pool offerings, staking amounts, Maker Vault collateral assets, re-staking assets, assets on bridges, RWA tokens, and more.Automatically crawls multiple chains and aggregates all asset valuations tied to user-provided address groups.

On-chain transaction history: the history of the user's past activity on the blockchain.Of particular interest is the history of DeFi loan borrowing and repayment, liquidation or not, trading history on exchanges, duration of wallet address (aging), and rate of return.Partner with external Cred Protocol and Blockchain Bureau to obtain scores and features based on user wallet behavior.

Off-chain financial asset dataOff-chain financial asset data: Asset balances in users' bank accounts, securities accounts, and central exchange accounts, including deposit account balances obtained through Plaid integration, securities account valuations, and crypto asset balances on exchanges such as Coinbase.

Off-chain income and cash flowMonthly cash flow estimated from the user's salary income, business income, and past deposits and withdrawals, etc. Since bank statements obtained from Plaid include payroll transfers, the average income for the last several months can be calculated, or for freelancers, the actual sales deposits.If you are operating with DeFi, the interest income from it (e.g., rewards from staking or liquidity offerings) can also be captured in the on-chain analysis.These ongoing cash flows are an important factor in determining credit lines and repayment rates, as they provide a source of future repayment.

Off-chain credit scores:American Credit Scores (FICO and VantageScore).If a user allows the Credit Karma linkage, he or she can obtain a score provided by Equifax or TransUnion.A number such as VantageScore 750, for example, indicates how creditworthy the user is in the eyes of traditional financial institutions.This will also be incorporated into 3Jane's credit assessment to reflect off-chain creditworthiness.

Identity verification and trustworthiness indicators: User's real name and address information, social ID, etc.For example, information that "this user is a KYC'd individual residing in the US" due to Coinbase authentication could carry weight during evaluation.This is because users with clear identities are less likely to make malicious default runs and tend to be more trustworthy than anonymous users.Also, whether the user has a proven track record on social networking sites (e.g., does the user have a job history that can be verified on LinkedIn) may be taken into account in the future.However, as far as 3Jane is concerned, KYC verification through Coinbase is all that is required.

With the above data in place, the 3CA algorithm internally calculates the user's overall credit score.The results of the calculation are, as described above, "Credit Line," "Interest Rate," and "Monthly Repayment Rate."The result of the calculation is calculated as a number in the following table.

The result of this calculation is written to the CreditLine contract, and theZK proofis attached.For example, it certifies that "the data provided by the user was indeed the source of the credit score calculation" and "the calculated score or credit limit was calculated according to the given algorithm".

By utilizing zkTLS, not only writing but also off-chain information collection, the protocol does not collect personal information, but only checks and verifies the information.Specifically, the Reclaim Protocol is used.

The zkTLS process itself also utilizes the security of EigenLayer's Restaking in order to conduct it in a secure and decentralized manner.

Zero-knowledge proofs ("this score calculation was done correctly", etc.) generated by 3Jane using the Reclaim Protocol and its own ZK circuits are verified off-chain by a group of nodes on EigenLayer, and only the results are reported to the mainEigenLayer verifies the zero-knowledge proofs generated by the EK Circuit (e.g., "this score calculation was done correctly") off-chain and reports only the results to the main chain.This greatly reduces the gas costs of running complex proof verification directly on Ethereum L1, while ensuring the authenticity of the proof by a large number of independent verifiers.

In addition, EigenLayer verification is applied to external data acquisition and calculation processes such as Plaid, Credit Karma, and Cred Protocol, making it possible to trace that the data was acquired and processed authentically.This ensures that the entire credit flow, including the borrower's financial data and credit score, is multiply checked to technically eliminate fraud.

◼️Default Response

Now, the last factor that cannot be left out is the "default response".Since this is an unsecured loan, there is naturally a risk of default, and 3Jane has a very unique mechanism for this "default response".

The 3Jane protocol in the event of default takes the following steps

Delinquency detection and credit slashing

Automatically determines default status if no payment is made after the minimum due date, and immediately reduces or denies future lines of credit by significantly lowering (slashing) the borrower's 3Jane credit score.

Accumulation and redistribution of delinquency penalties

We calculate and pool the penalty interest rate (overdue interest) incurred during the delinquency period and distribute it to other borrowers who were in good standing at the time of successful collection at a later date.

On-Chain Loan Auction

Non-performing loans (NPLs) that have not been repaid within a certain period of time are sold to registered collection agencies through Dutch-style (diminishing price) Dutch auctions, and the debt collection rights are transferred to the agency that responds with the most favorable terms (lower compensation rate).

Off-chain collection phase

The successful collection agency will attempt to repay the borrower through traditional means such as TLOxp or through legal enforcement procedures after being disclosed the encrypted borrower's name and contact information, and if successful, a portion of the principal and interest will be returned to the pool (vendor fees will be paid at a pre-agreed percentage).

Final loss disposition

The book value of loans determined to be uncollectible is impaired in stages, with losses incurred first by the sUSD3 holder, and the remaining losses are divided among the USD3 holders on a pro-rata basis.This keeps the risk within manageable limits despite the unsecured nature of the loan.

There are three key points.

First, the delinquency penalty rate is distributed to borrowers who continue to make sound repayments, thereby increasing the incentive to make sound repayments.If repayment is still not made, the collection process is initiated through legal proceedings.

The following signatures are performed in item 6 of the borrower flow described above, which will have legal effect upon collection even though the loan is an unsecured on-chain loan.

Electronic signature of the terms of the MCA (Future Receivables Assignment Agreement, Merchant Cash Advance), legally acknowledging the repayment obligations associated with the unsecured loan.

For this purpose, NPLs that have defaulted are auctioned on-chain and sold to affiliated vendors.The vendor will perform legal collection procedures with the incentive of a reward upon collection set at the auction (e.g., 30% of 100% collection is the vendor's reward).

In this process, personal information collected by zk proof is disclosed only to the collection agency.This allows us to identify the individual who is the creditor.

If collection is still not possible, a default will occur, but here is the last point.The loss in the event of this default is suffered primarily by the sUSD3 holder and subsequently affects the USD3 holder. sUSD3 holders, while normally receiving a favorable yield, are the first to take the risk in the event of default.

For this reason, sUSD3 is capped at a maximum of only 15% of the total pool.

The above mechanism is designed to work unsecured borrowing.

🚩Transition and Outlook

3Jane was founded in 2024 by Jacob Chudnovsky. acob was an early member of Ribbon Finance (an options trading and revenue optimization protocol for DeFi) for almost 3 years, gaining experience while moving from smart contract developer to growth strategyHe gained experience while shifting roles from smart contract developer to growth strategist.

The product is being developed in stealth, and in June 2025, the company announced a seed round of $5.2 million in funding and revealed its product concept.

Lead investors are Paradigm, with industry leaders including Coinbase Ventures, Robot Ventures, and leading market maker Wintermute.In addition, well-known DeFi developers such as Andre Cronje (Founder, Yearn Finance) and Kain Warwick (Founder, Synthetix), as well as private investors such as Julian Koh (Co-Founder, Ribbon Finance) and DeFi Dad (DeFi influencer)DeFi Dad (DeFi influencer) and other private investors and advisors are also participating as investors.

A portion of the funding is expected to be used to prepare for the mainnet launch of the protocol and for regulatory compliance (particularly with US regulations related to unsecured loans).

Currently, the protocol is open exclusively to U.S. users and is available only to borrowers.(Lend to SOON).

↑This APY shows that even USD3 yields 9.52% and sUSD3 yields 22.72%, which is quite high.

Currently, the credit algorithm 3CA is being adjusted, and in the subsequent phase, the USD3 and sUSD3 pools for lenders will be opened to the public.The timing is yet to be determined.

No mention of tokens yet.

💬Possibility of legally binding DeFi

Finally, a summary and discussion.

This is a very interesting mechanism.

It has always been pointed out that traditional over-collateralized DeFi lending has led to capital inefficiencies, but even so, it has been considered unavoidable with the anonymity and permissionless nature of DeFi.Determining credit limits based on on-chain history has also been discussed and experimented with, but honestly, only a portion of a person can be determined based on on-chain history alone, and creating a single credit limit based on multiple wallets was risky because it would reveal coordination between wallets.

We also pointed out that the lending mechanism as it is would not expand beyond DeFi's TVL, and 3Jane's proposal to replace all existing financial lending markets by also utilizing off-chain information in order for DeFi to be integrated into society.

The technologies that make this possible are "zkTLS" and "re-staking" which verifies them in a decentralized manner.We have presented the possibility of a new era of lending using exactly what has been verified and developed as a technology over the past few years.

This cross-fertilization ensures the splendor of DeFi, which is anonymous and permissionless, while the risk of default is mitigated by legal binding force.

It is particularly interesting to note that the system is automated in that it can be used anonymously if used in a healthy manner, but if you commit fraud, your personal information will be disclosed and legally collected.Moreover, since all of this is done using smart contracts and zkTLS, it is done automatically without any storage on the part of the protocol.I believe that this is the way of the new era of DeFi in the real world, where personal information is disclosed only when necessary according to the rules (code).

In addition, 3Jane is not only revolutionizing the lending mechanism for humans with this system, but is also targeting the lending market for AI agents.The model is to lend to AI agents in the future based on their history and future cash flow projections when they conduct economic activities, and earn interest.

DeFi has accelerated at a great speed in the past, but regulations and other factors have been a major barrier.In the future, if zero-knowledge proofs such as zkTLS are utilized, the philosophy of DeFi may be preserved, but it may become a form of cohabitation with regulations and laws.

If this happens, it does not seem impossible to realize a future where all financial infrastructure is DeFi, and the current market size growth speed may be further accelerated.

First of all, I would like to follow the future development of "3Jane" and whether it will actually work.

This is my research on "3Jane"!

🔗Reference Link:HP / DOC / X / BLOG

Disclaimer:I carefully examine and write the information that I research, but since it is personally operated and there are many parts with English sources, there may be some paraphrasing or incorrect information. Please understand. Also, there may be introductions of Dapps, NFTs, and tokens in the articles, but there is absolutely no solicitation purpose. Please purchase and use them at your own risk.

About us

🇯🇵🇺🇸🇰🇷🇨🇳🇪🇸 The English version of the web3 newsletter, which is available in 5 languages. Based on the concept of ``Learn more about web3 in 5 minutes a day,'' we deliver research articles five times a week, including explanations of popular web3 trends, project explanations, and introductions to the latest news.

Author

mitsui

A web3 researcher. Operating the newsletter "web3 Research" delivered in five languages around the world.

Contact

The author is a web3 researcher based in Japan. If you have a project that is interested in expanding to Japan, please contact the following:

Telegram:@mitsui0x

*Please note that this newsletter translates articles that are originally in Japanese. There may be translation mistakes such as mistranslations or paraphrasing, so please understand in advance.