Happy New Year!

Mitsui from web3 researcher.

We will be closed only on December 31 and January 1, and this article will probably go up on January 2.We will be updating the article as usual starting today.Thank you for your continued support this year!

Today, looking back on the year 2024, I would like to introduce some of my personal favorite projects.Please note that these are projects that I thought were interesting on a completely subjective basis, not because of their future potential.

1, Polymarket

As you all know, Polymarket has taken a big leap forward after the US presidential election.I personally believe that Polymarket is the only product in the blockchain space at this stage that has achieved PMF.

I too was shocked when I looked into how Polymarket works.Simply put, it is just a betting site, but the impact it has and the reasons why it should be implemented on the blockchain are also present, and I even thought it was a perfect mechanism as one of the social implementations of the blockchain.

Prediction Market (Polymarket) has been called the future of news, and I don't think that's an exaggeration.The value of the prediction market should increase every year as one anchor in today's world, where it is becoming increasingly difficult to feel objective predictions due to the growth of only articles that get attention through monetization by advertising.

Perhaps the breakthrough will continue in the future in a more media-embedded way.

For example, Decrypt, a very well-known crypto company, has launched its own product, MYRIAD, a prediction marketplace.

I believe we will see more cases like this started or incorporated by media in partnerships.

2, Sanctum

The second is Sanctum, which may not be as well-known as Polymarket, but it was also very exciting.

Sanctum allows each protocol to freely issue LSTs.For example, there is the $bonkSOL LST issued by Solana's $BONK meme coin.While $bonkSOL is a Solana LST, it also enjoys $bonkSOL-specific benefits, such as the $BONK airdrop, for example.

I wrote about the concept of "investment consumption" in a previous article.

This is a system in which LSTs are issued to brands or individuals that you support, and you can receive additional benefits from the brand or individual without decreasing (or rather, increasing) your own assets.

This very movement has recently emerged with the Creator Coin mechanism.This is a system whereby holding each creator's LST allows you to receive LST yields plus benefits specific to each creator.

We believe this is a system that will revolutionize the way we consume and invest.

For example, instead of paying to join a fan club, you can deposit a certain amount of money to receive benefits.Not only will your money not be reduced, but rather it will be returned to you with a small increase.Restaurants could also allow you to eat for free if you deposit money.

The risks at the moment are LST depegging and protocol hacking risk, as well as the price decline of SOL itself and the collapse of the staking system.However, if the SOL ecosystem collapses, there is nothing we can do about it, but I believe that eventually there will be a protocol that allows USDC to issue LSTs, and if that happens, I expect that it can be promoted as a case study for enterprise companies.

Personally, I think it would be easy to use in the donation area, such as ReFi, so we are looking in that direction.

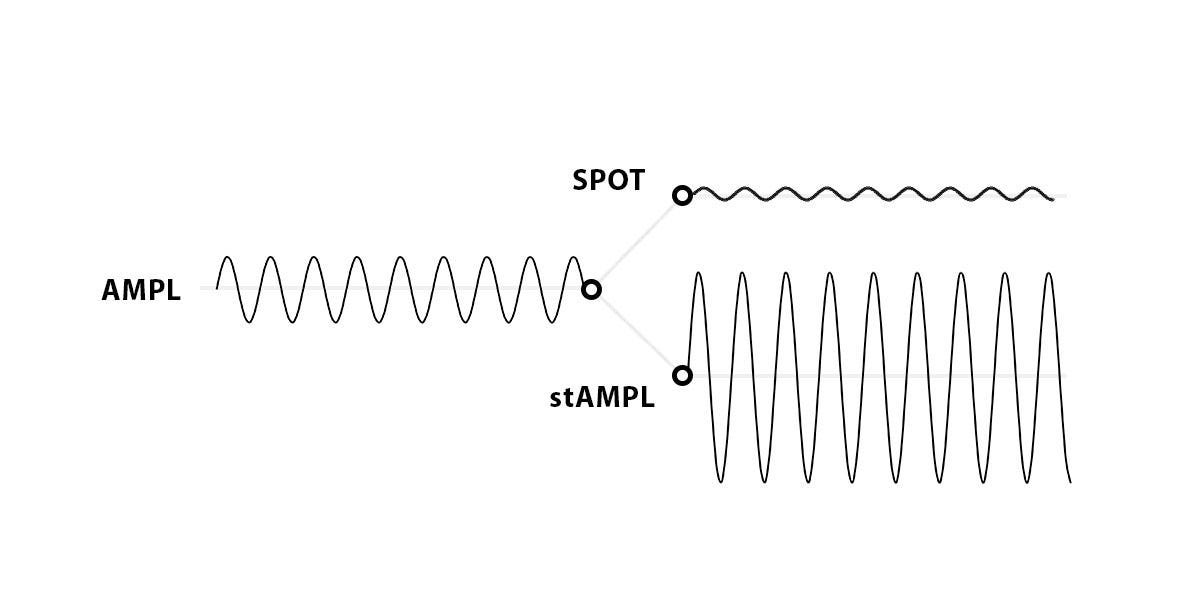

3, AMPL and SPOT

This is a prime example of programmable money, which is mentioned frequently in X.It is a very interesting area, although the mechanics are very esoteric.

Flatcoin is the next cycle of development after stabled coins, related to the Consumer Price Index (CPI) or purchasing power

and Brian Armstrong, CEO of Coinbase, said he is looking at flatcoin as a direction for venture investment in 2023.

Here is a brief explanation of flat coins.

Currently stabled coins are collateralized by legal tender and are inevitably affected by the drawbacks of legal tender.That disadvantage is inflation.

Legal tender is known as easy money, and because it is easy to issue, it is issued without limit, diluting its value and causing inflation to continue.As a result, if legal tender is left in a bank account, the value of the currency is damaged and its purchasing power decreases.

Flatcoin is a currency pegged to purchasing power; it is linked to the consumer price index, known as the CPI, and is intended to be a currency whose purchasing power does not change.

Its structure ensures stability by building two investment products with diverging risks.The stable investment product side is the flat coin.

This is a difficult area, please see previous articles for more details.

I also found this initiative to evolve stablecoins interesting, specifically Anzen and Resolv.Flatcoin and delta-neutral stablecoin may be concepts a bit further down the road, but Anzen could still be a focus in 2025.